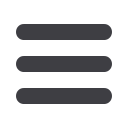

The economic situation of the companies included in the 2015 sample has improved, compared to that of respondent

companies in the previous years. More than 68% of companies from Continental Europe and the Anglosphere have

sustained or increased their revenue this year. Conversely, 65% of Russian companies suffered a loss of revenue. This

positive indicator is offset by the results reported by the very small businesses (revenue < $50 million): most of them

(51%) have registered revenue stagnation or decrease (strong revenue decrease for 20% of them).

Fig. 3 Revenue development by geographic area (%)

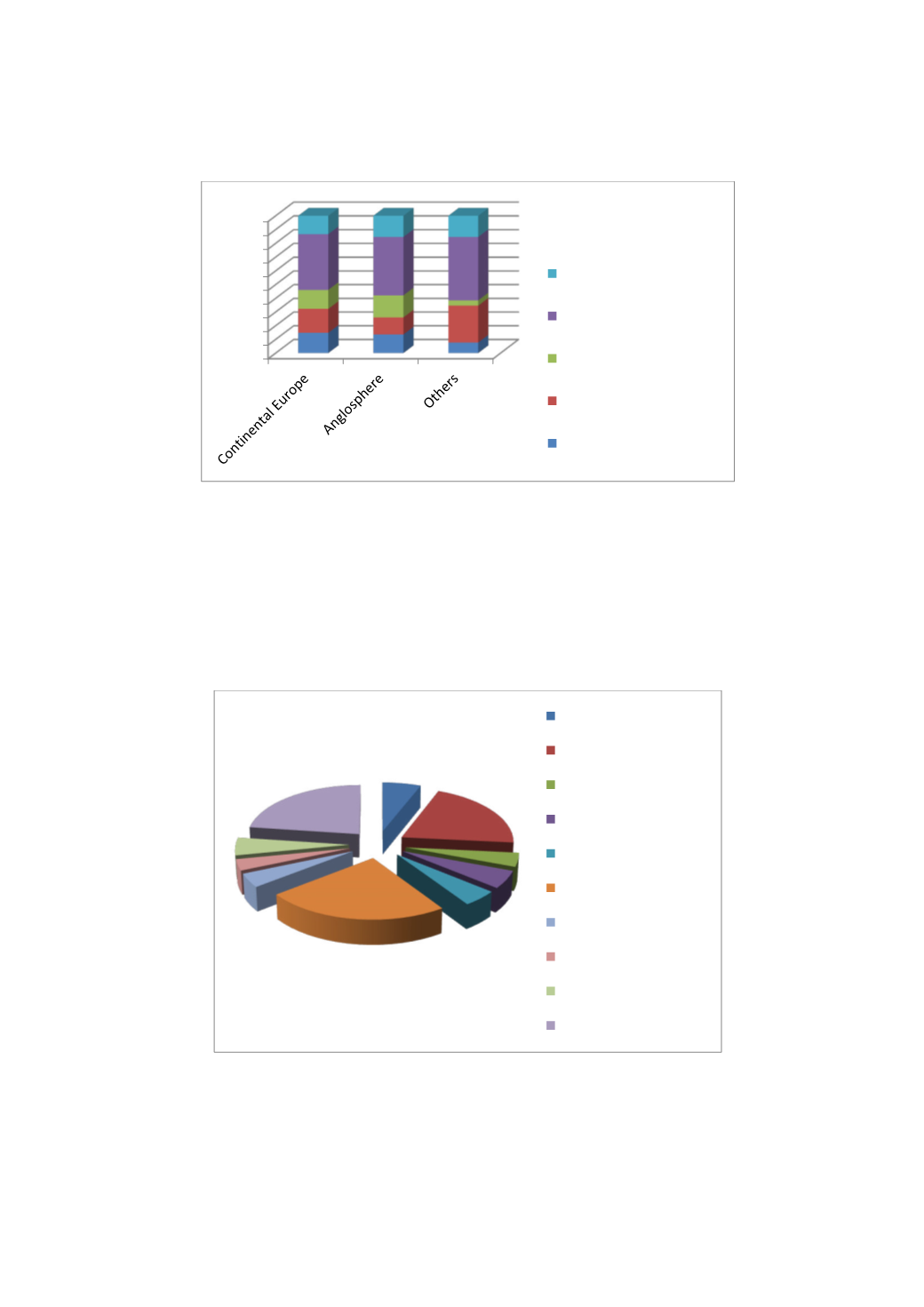

Finally, the economic profile of the companies in the 2015 sample presents a particular feature: three sectors carry a

significant weight (67% of the total sample): banking/financial services, other services, and industry. The sectors,

however, are different depending on the geographical areas. The banking and other services sectors are dominant in

the Anglosphere (67%), whereas industry and, to a lesser extent, other services have the most weight in the

Continental Europe group (50%) or in Mexico in particular (87%).

Fig. 4 Sector breakdown in 2015

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

Significant increase ( >

+10%)

Slight increase

No increase

Slight decrease

Significant decrease ( < -

10%)

6%

21%

4%

5%

5%

24%

4%

3%

5%

23%

Consumer Products

Industry

Energy & Utilities

Engineering &

Construction

Distribution & Trading

Bank, Insurance &

Financial Services

Public administration

Transport and Logistics

Media, Telecom and IT

Other Services

IAFEI Quarterly | Special Issue | 9