It took only 3 years until 2003, that 2 major states, Germany and France, broke the rule of not

exceeding the 3 % annual government budget deficit, and since then, again and again this

rule, and also other rules ( ! ), have been broken by the same 2 countries and by many other

Euroland member countries. To the degree, that rule breaking has become common place.

Worse than that, from the beginning, 2 states were admitted to the Euro, Belgium (118%) and

Italy ( 126%), which had government debt outstanding of over 100 % of GDP. Promises to

bring this down considerably over time, have not been fulfilled, to the contrary, government

debt was expanded in Italy towards 132 % of GDP, (Belgium now 107%).

And then came the great financial crisis 2008 to 2009, when many European countries had to

bail out failed banks, and when governments did that by incurring huge additional debts,

which had not been thought of before and budgeted before, and which led to the effect, that

the governments of Euroland are now higher indebted and leveraged, than ever before since

WorldWar 2

nd

, and way beyond the Maastricht Criteria.

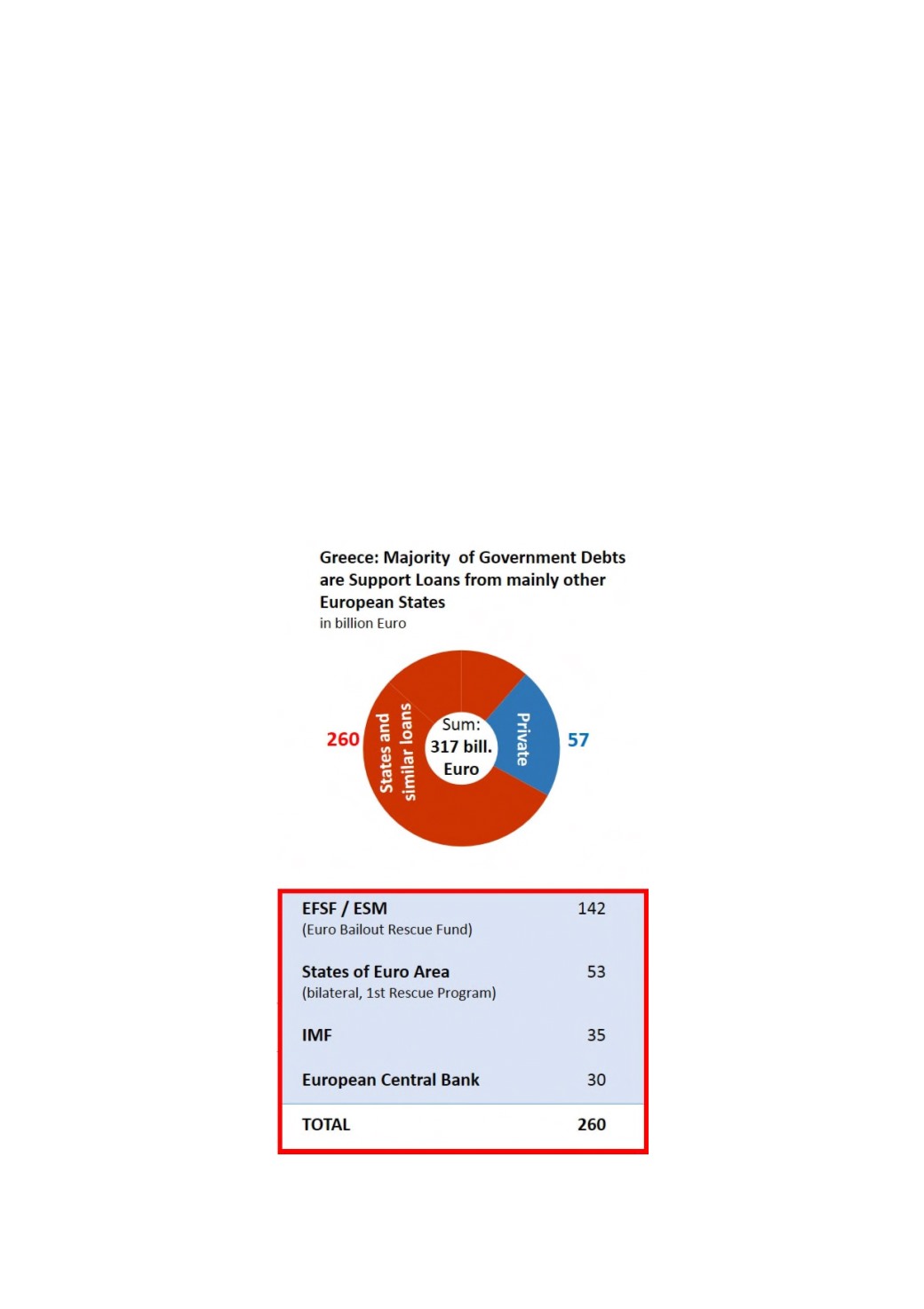

Then in 2010 and in 2012 came the Greek Crises, and the tedious and painful effort of the

other Euroland countries, to help out Greece from the brink of insolvency and bankruptcy, by

installing a great bail out architecture which as of present looks like this:

IAFEI Quarterly | Issue 29 | 13