Riccardo Barbieri Hermitte, speaking from Italy, stated that

«the Government is aiming to lift real GDP growth above

1.6%” which is forecast for 2016 and to reduce the debt to

GDP ratio. Italy’s credibility is growing thanks to the fiscal

discipline which we have demonstrated, by controlling spen-

ding»

. Also Gregorio De Felice was optimistic and, in his

view, the outlook for the Italian economy is favourable and

the country’s GDPwill grow by more than 1% in 2016-2017.

«However,»

the economist added

«growth will be lower than

the 1.6% forecast by the Government and will stand at

around 1.2 and 1.4% respectively for 2016 and 2017»

. Mo-

nokroussos spoke of Greece in positive terms, illustrating

22

27

28

29

30

23

24

25

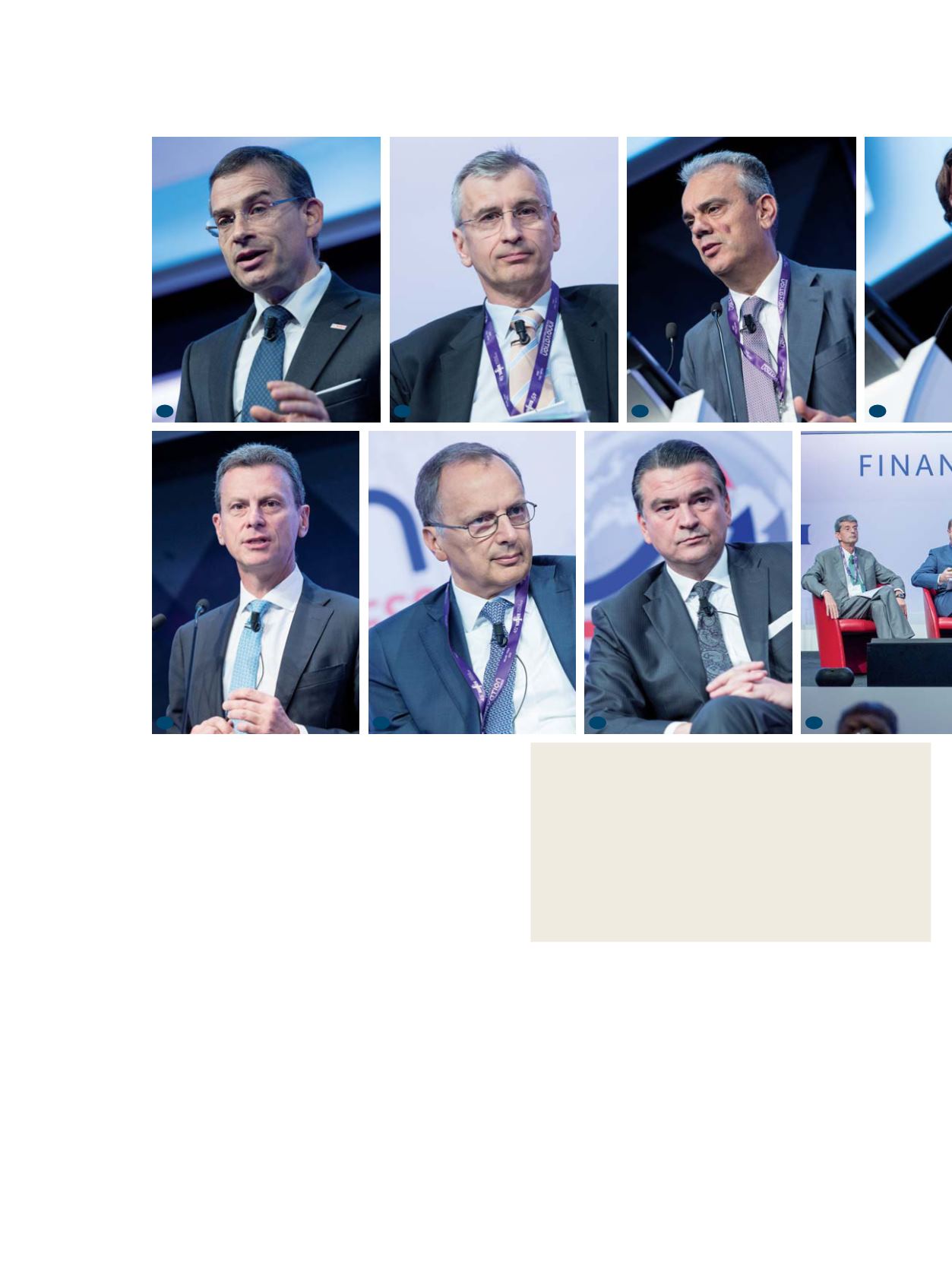

22.

Gerhard Dambach, CEO Southern Europe Bosch Group

and CEO Italy Robert Bosch;

23.

Armand Angeli,

IAFEI Organizing Committee and Area President EMEA ;

24.

Donato Iacovone, Managing Partner Med EY;

25.

Valerio

Nannini, Senior VP and Head of Strategy and Performance Nestlè;

26.

Sergio Lamonica, IAFEI Organizing Committee;

27.

Riccardo

Barbieri Hermitte, Chief Economist Ministry of Economics and

Finance of Italy;

28.

Gregorio De Felice, Head of Research and

Chief Economist Intesa Sanpaolo;

29.

Platon Monokroussos, Deputy

General Manager and Group Chief Economist Eurobank Ergasias;

30.

Panel Capital Markets and Crossborder Investments

According to Valerio Nannini, Senior VP, Head of Strategy

and Performance Nestlè, growth is becoming the lifeblood

of the global economy and the strategic priority of CEOs

and CFOs. On financial markets companies are increasing

their value thanks to innovation, but to achieve innovation

the main element must be passion. Entrepreneurship and in-

novation must become a single being.

Tax policy and debt sustainability

How sustainable is the debt? Howmuch can be paid back? Not

only public debt, but also household and business debt. Cur-

rencies and interest rates are positively influencing the GDP

of key countries in the euro zone and peripheral countries, but

the sustainability of sovereign debt is linked to stronger growth

prospects, greater flexibility in the growth and stability plan,

and the need for investment in innovations that can support the

creation of jobs and greater productivity. These issues were di-

scussed by the panel moderated by Sergio Lamonica, IAFEI

Organizing Committee, featuring Riccardo Barbieri Hermit-

te, chief economist at the Ministry of Finance and Economy,

the chief economist of the Intesa Sanpaolo Group Gregorio de

Felice and Platon Monokroussos, Deputy General Manager

and Group Chief Economist Eurobank Ergasias Greece.

IAFEI Quarterly | Issue 31 | 12