SHUTTERSTOCK

New terminology regularly appears in the inancial world along

with an assumption that we will all magically understand the

new concept.

For example, the regulatory authoritiesǯ approach towards inancial

institutions and Ǯtoo big to failǯ has evolved as a result of the global

inancial crisis. Terms such as Ǯbank resolutionǯ and Ǯbail-inǯ are

frequently used and it is assumed everyone understands them.

This article ȋextensively based on articles produced by the Bank

of EnglandȌ is intended to explain just what these terms mean.

During the global inancial crisis, banks faced signiicant losses that

reduced the value of their balance sheets to such an extent that they

lost access to liquidity. This so seriously constrained banksǯ activities

that the authorities were forced to intervene to stop banks from

collapsing and taking the real economy with them. This intervention

was provided in a number of ways:

– emergency funding to inancial markets

and individual inancial institutions to ensure that they could

continue to meet their obligations as they fell due.

– selected asset classes, such as corporate bonds,

were purchased from inancial institutions to improve the liquidity

of credit markets.

– public authorities guaranteed some

liabilities, such as deposits or new/existing debts, to shore up

conidence in the inancial system.

– or Ǯbailoutsǯ were provided in exchange for

full or partial ownership of individual irms. Thus depositors were

bailed out ȋsavedȌ contrasting with Ǯbail-inǯ where they take losses.

)n the US, 9͢͡ irms, including some non-inancial institutions,

beneited from some form of government assistance, amounting to

date to around $ͣ͢͝bn.

͝

)n the UK, the support was more sector-wide, with speciic support

for only four banks, amounting to £͝,͢͝͞bn at its peak.

͞

Although this stabilised the inancial system successfully, the cost

was borne by the public sector and shareholders rather than the

banksǯ depositors. Shareholders did lose because share prices fell

Business skills

Treasury essentials

The

bailout

lexicon

MANY FINANCIAL EVENTS AND ERAS ATTRACT THEIR OWN TERMINOLOGY AND JARGON – AND THE

AFTERMATH OF THE 2008 FINANCIAL CRISIS IS NO EXCEPTION. SARAH BOYCE AND WILL SPINNEY

PROVIDE A TRANSLATION AND LOOK AT THE IMPLICATIONS

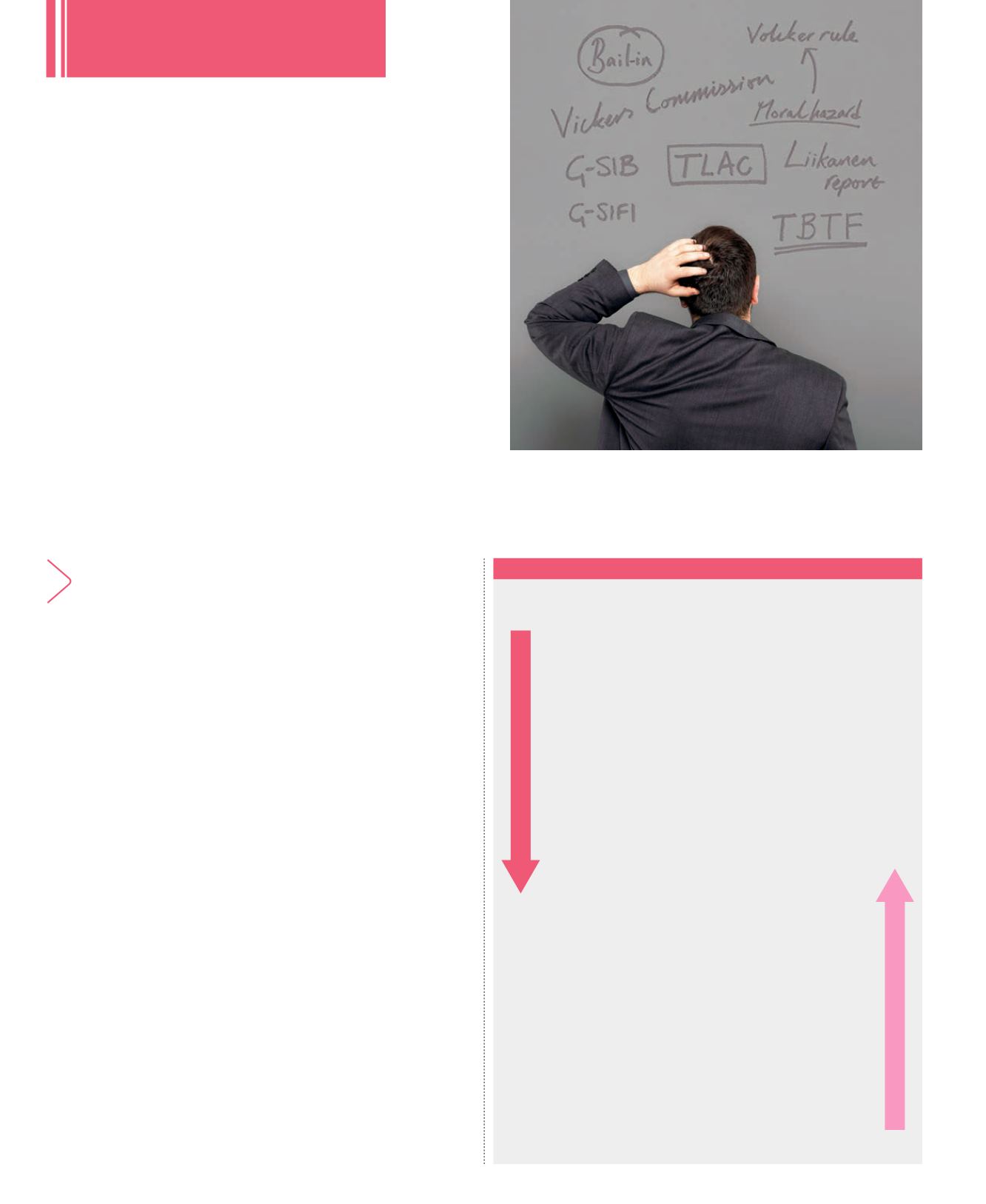

Bail-in hierarchy

Below is the order in the UK in which capital is bailed in to resolve

a failed bank. Order of priority (from January 2015):

Fixed charge holders

(ie security in the form of: mortgage,

fixed charge, pledge, lien), including:

• Capital market transactions (for example, covered bonds)

• Trading book creditors (for example, collateralised positions)

Liquidators

(fees and expenses)

Preferential creditors (ordinary)

, including:

• Financial Services Compensation Scheme (FSCS),

taking the place of all protected depositors for amounts

up to £85,000

• Employees with labour-related claims

Preferential creditors (secondary)

:

• Depositors that are individuals and micro-, small- or

medium-sized businesses for amounts in excess of £85,000

Floating charge holders

Unsecured senior creditors

, including:

• Bondholders

• Trading book creditors (for example,

uncollateralised positions)

• Creditors with master netting agreements

(net position only)

• Commercial or trade creditors arising from the provision

of goods and services

• Depositors that are not individuals or micro-, small-

or medium-sized businesses for amounts in excess

of £85,000

• FSCS, taking the place of individuals with funds invested

with the insolvent firm (including protected amounts up

to £50,000)

Unsecured subordinated creditors

(for example,

subordinated bondholders)

Interest incurred post-insolvency

Shareholders (preference shares)

Shareholders (ordinary shares)

Proceeds flow down

Losses flow up

Source: www.bankofengland.co.uk/financialstability/Documents/resolution/apr231014.pdf

IAFEI Quarterly | Issue 31 | 66