We have a similar to Europe situation in the United States of America, where the government

debt ratio is presently 110 % of GDP. And we have the most extreme situation in Japan,

where for country-specific reasons the government indebtedness is at around 250 % of GDP.

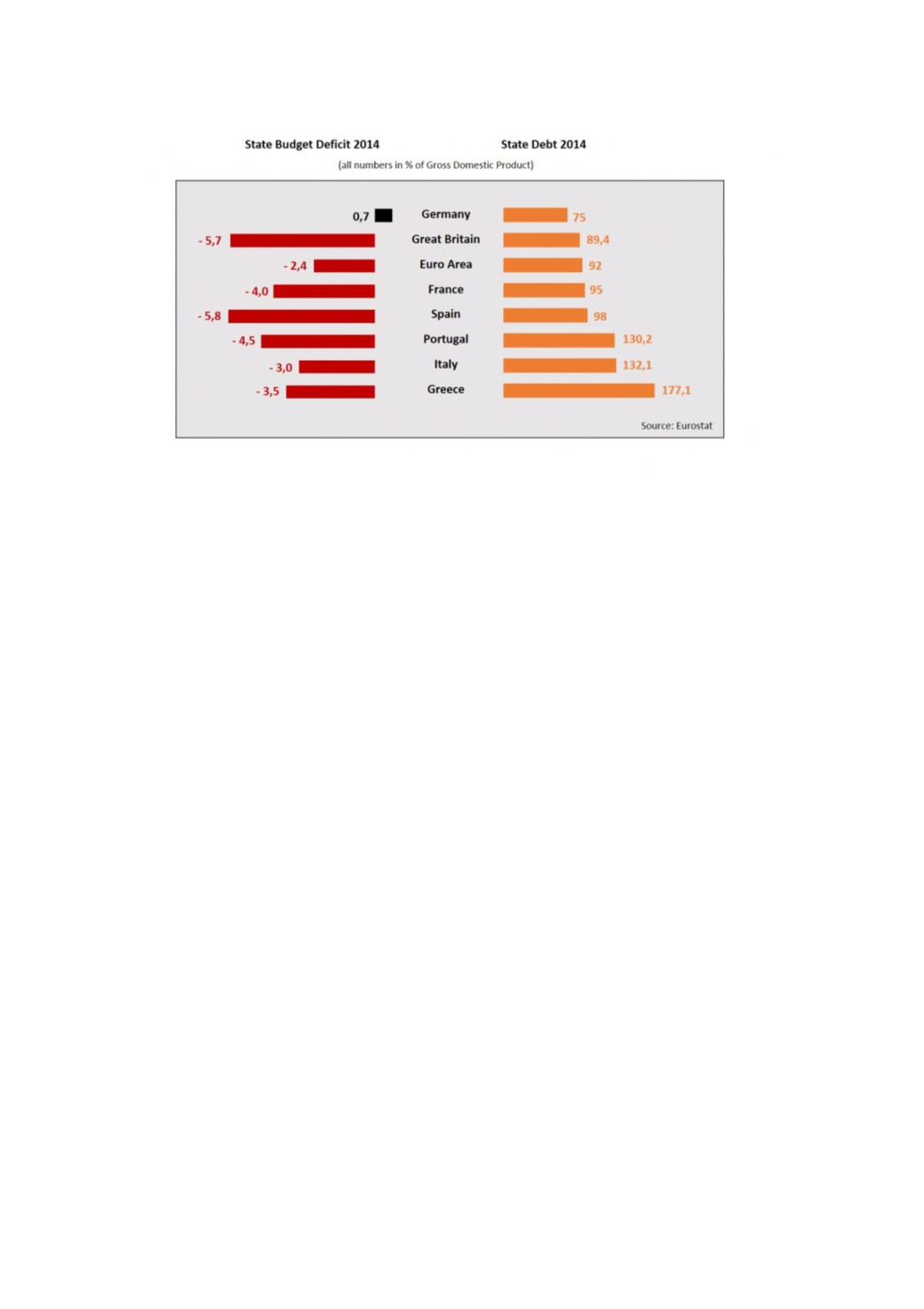

You see also on this chart the annual 2014 government budget deficit in % of GDP, and with

the exception of Germany, they all on this chart are above the Maastricht criterion of an

annual government budget deficit of 3 % of GDP.

However, this chart does not show all 19 member countries of the Euro.

The good news is, that out of the 19 member countries of the Euro, still 7 countries in 2014

are meeting this budget deficit criterion and are below the 3 % ratio.

And as you see from this chart, the annual budget deficit of all 19 Euro Area Countries is at

minus 2.4 % in 2014, down from the minus 2.9 % of 2013. So there is some improvement.

There is a kind of consensus among many representatives of the Western World countries,

that from here on the government indebtedness should not be increased further.

What acts as a brake against a further significant increase of government indebtedness, is the

fact, that with such an excessive indebtedness goes an interest expense burden, which takes an

ever increasing bite out of the government budgets and which leaves such budgets with a

sinking portion of their government tax and other available income available for all typical

other political purposes.

Raising taxes further to higher levels is not a remedy to this situation, because in many of

such countries, the existing tax level is already considered as a very high, if not too high

burden for the people, and to the degree that there is even disincentive to people for doing

business and paying taxes.

IGTA eJournal | Summer 2015 | 18