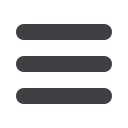

Philip Smith

is a

freelance journalist,

editor of

London

Accountant

and a

contributing editor

to

Accountancy

to go hand in hand with improved

investor protection, and greater clarity

for the consumer.”

A further issue revolves around which

companies could benefit from the CMU

initiative. While the Commission talks

about SMEs, it is clear that capital

markets are really only relevant for

mid-cap and larger companies. The

costs of going direct to the markets

for financing rather than to banks are

significantly higher.

As Marte Borhaug, senior policy

adviser on financial services for the

Confederation of British Industry, told

a stakeholder’s meeting hosted by Lord

Harrison prior to the release of the green

paper, it was important to focus on who

CMU was trying to help and ensure it

was not just talking about SMEs in terms

of their size, but whether they were

growing and had the ambition to grow.

She added that there were things that

could be done to improve the market,

but companies also needed to take the

initiative to look for alternative sources

of finance.

Learning curve

SMEs could still benefit, however. As

Grout says: “If you further the ability of

larger companies to take funding from

the market rather than from banks,

banks might need to look for something

else to do, and that might mean lending

to SMEs. It is a second tier effect.”

So what will this mean for corporate

treasurers? If the objective of the CMU

is to reduce the reliance upon bank debt,

then larger and mid-sized companies

will have to go to the markets, argues

Grout. “The relevance to treasurers is

that they need to follow what is going

on; they will need to work out how

they are going to use capital markets

and when they are going to use capital

markets. How will they explain this to

their boards?

“There will be a learning curve for

treasurers, and the nature of their

relationships with banks and the capital

markets will change.”

“The objectives of the proposals on Capital

Markets Union are quite laudable,” says

James Kelly, head of treasury at pest

controller Rentokil Initial. He notes that

while there are some “big challenges”

to the proposal, such as encouraging

investment across borders and changing

the preference for funding in-country, the

benefits could be significant if the union

is successful.

Kelly continues: “At the moment, euro

markets are receptive to smaller trades,

such as our recent €50m floating-rate

note, but in more volatile markets,

minimum deal sizes would be substantially

higher. Creating a broader range of

markets, including developing the private

placement market and encouraging peer-

to-peer lending, would reduce the risk

for borrowers of either not being able to

raise money or only being able to raise

an amount that is substantially more than

is needed.”

He concludes: “Clearly, there’s no

guarantee of success and we’ve seen

with the Single Euro Payments Area how

timescales can slip. But, overall, these are

initiatives that should be encouraged.”

THE TREASURER’S VIEW

PHOTOGRAPH: CHARLIE BEST

IAFEI Quarterly | Issue 29 | 49