Context of treasury

Accounting, tax and regulation

The Shanghai Free Trade

Zone is a leader in financial

services, with multiple

international banks, and

domestic Chinese banks

using it as their headquarters

in China. Other service

industries in the free trade

zone include shipping

services, business services,

professional services, and

cultural and social services.

Furthermore, the

Shanghai Free Trade Zone

has attracted some large

multinational companies,

including technology giants

Microsoft and Sony. Some

90% of companies in the

zone are Chinese and

they are benefiting from

the liberal policies for

outward investment.

internationally and then

progress its convertibility.

A key part of China’s

financial reforms is the

establishment of free trade

zones, which are designed

to test the impact of free

market reform and the

liberalisation of FX policies

on the Chinese economy

before these are rolled out to

the rest of China. It is hoped

that the free trade zones will

accelerate the liberalisation

of the financial sector,

increase cross-border trade

and investment flows, and

boost growth in domestic

services and innovation. The

first free trade zone, which

was established in September

2013 in Shanghai and its

surrounding area, is 120.7km

2

in size.

Specifically, the pilot free

trade zones (PFTZs) aim to:

• Promote free trade;

• Progress financial reform;

• Simplify administration;

• Upgrade customs

procedures;

• Open up China’s

investment sector;

• Create a competitive

regulatory and tax

environment; and

• Operate as a test market

for national reform.

Following in

Shanghai’s footsteps

Earlier this year, China

unveiled three new free trade

zones that are modelled

on Shanghai, but have

different local economies

and geographies.

Tianjin Free Trade Zone

has been established to

operate as a gateway to the

economic zone in northern

China. Its industries include

aerospace, automotive,

financial leasing, high-

end manufacturing,

petrochemicals,

pharmaceuticals, metals and

mobile phones. With modern

infrastructure including

Tianjin Port (the largest

port in northern China) and

Tianjin Airport, it is expected

The first wave of overseas

investment in China

began in the 1990s.

Those early adopters saw

the potential of the Chinese

market and its vast

population. Twenty-five

years later, the second wave

of international investment

has begun, prompted

largely by the Chinese

government’s establishment

of free trade zones.

In the past, international

investment in China has

been limited for a number

of reasons. These include:

all investment being

restricted and subject to

approval; the Chinese not

being allowed to own foreign

debt; and the Chinese capital

markets not being open to

foreign investors.

The slowdown in China’s

GDP growth over the past

10 years has led the Chinese

government to introduce

an alternative strategy,

however. It has adopted

internal financial reform and

a process to internationalise

its currency, the renminbi.

As a result, the focus of the

People’s Bank of China is

to increase the liquidity

and circulation of the

renminbi, increase its usage

FREE TRADE ZONES IN THE WORLD’S SECOND-LARGEST

ECONOMY OFFER LIBERAL FINANCIAL AND TRADE

POLICIES, AIDED BY MODERN INFRASTRUCTURE AND

SUPPORTING BUSINESSES, SAY YANG DU AND EASON SHI

A foothold

in China

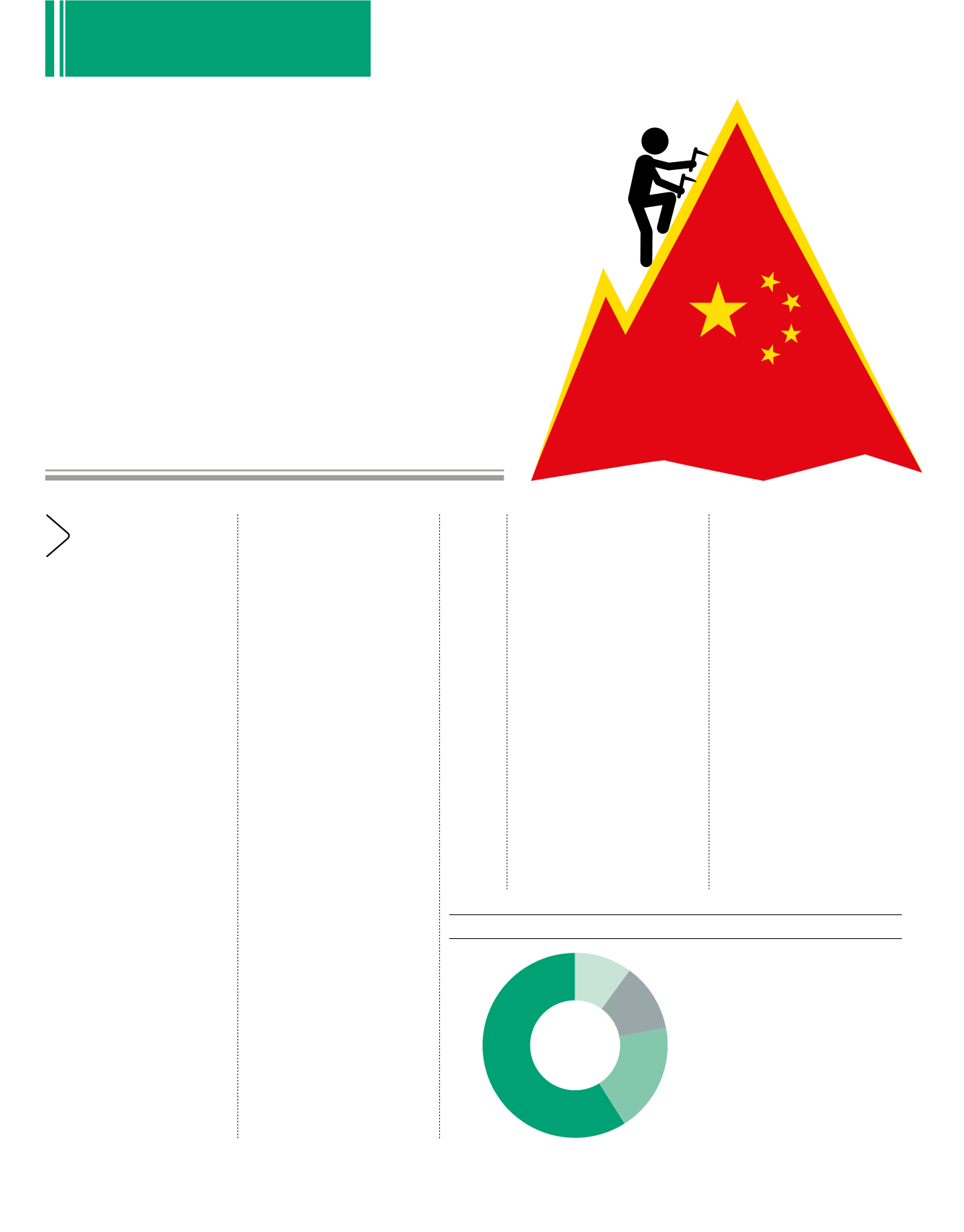

SHANGHAI FREE TRADE ZONE IN NUMBERS

l

Trading

59%

l

Service

19%

l

Manufacturing and R&D

12%

l

Foreign-owned

10%

59%

19%

12%

10%

23,000

companies

47

banks

300,000

workers

IAFEI Quarterly | Issue 29 | 5