Having the ability to operate

cash pools and to move cash

simply in and out of China are

notable advantages. More than

60 companies are operating

a foreign currency pool in the

Shanghai Free Trade Zone,

while more than 140 have a

renminbi pool. In a free trade

zone, a company that uses

a cash pool can remit foreign

currency freely without

worrying about FX controls.

Key considerations for

international investors

While there are many reasons

for international investors

to choose to locate in a free

trade zone, it should be

acknowledged that the

regulation in operation

within a free trade zone is

different from that in the rest

of China. Since these liberal

policies are not guaranteed,

there is always a risk that the

central government could

change the free trade zone

policies if it considers them

potentially inappropriate for

the rest of China.

In order for a company

to benefit from free trade

zone policies it must have

a registered office in the

zone. Free trade zones are

suitable for both large and

small companies, but any

international investor must

make a capital commitment

that is based on their

operational forecast and

specified in their articles of

association. The capital is not

To see the list, visit www.

shanghaifreetradezone.org/en/Negative_List.pdf

2. Simplified outbound

investment

management.

Filings for

domestic companies take

five days for outbound

investment, and one day for

FX and payments. Outside

a free trade zone, filings

can take up to five months.

3. Reduced customs

procedures.

Imports are

held in the free trade zone

without inspection until

the goods are sent to the

domestic market, which

reduces import times.

4. Financial innovation.

There are many financial

benefits, which include the

operation of a renminbi

cash pool, a foreign currency

cash pool, centralised FX

operations, the removal

of government restrictions

on FX and access to the

interbank markets.

5. Preferential interest

rates.

Banks in the free

trade zones are able to offer

preferential rates, meaning

businesses may be able to

negotiate a rate less than

the 6% offered in the rest

of China.

6.Preferential tax rates.

In

some zones, tax treatment

is different from the

domestic market. For

example, in the Shenzhen

Free Trade Zone, tax is

15%, compared with the

25% domestic tax rate.

Given these benefits, it

is clear that any company

looking to do business in

China should consider

locating to a free trade zone.

to boost the economies in

Beijing, Tianjin and the

Hebei Province, and support

developing trade relations

with Japan and South Korea.

Fujian Free Trade Zone

has specialist industries

including electronics,

petrochemicals and

mechanics. It also operates

as the logistics centre for

southern China, which is

developing new railways, ports

and highways. It is a major

strategic zone for trade with,

and investment from, Taiwan.

Guangdong Free

Trade Zone

has a wide

range of industries,

including automotive,

building materials,

electrical machinery,

electronics, food and

beverages, petrochemicals,

pharmaceuticals and textiles.

Its primary focus is to

develop financial services and

customs clearance. Due to

its location, it is expected to

further relations with Hong

Kong and Macau, ultimately

further connecting China with

Southeast Asia, Africa and

Europe. Shenzhen Free Trade

Zone, which was approved

by China’s State Council in

April 2015, is a part of the

Guangdong Free Trade Zone.

Key benefits

Free trade zones offer many

benefits to both domestic

Chinese and international

companies. These include:

1. Simplified business

processes.

Establishing

your business involves

reduced administration

and more lenient processes.

If your business sector is

not on the ‘Negative List’,

then it only takes seven

working days to receive

all the licences necessary

to start operations. By

comparison, establishing

a business outside the

free trade zones takes

approximately 30 working

days. The Negative List is a

list created by the Chinese

government of 122 items

that foreign companies are

not allowed to invest in.

Yang Du

is head of

China Desk at Thomson

Reuters and

Eason Shi

is senior manager at

Shanghai Waigaoqiao

Free Trade Zone United

Development Company

With thanks to Jessica Zhang, senior manager,

Shanghai UDC Business Consulting Company

To learn more about Thomson Reuters

corporate treasury solutions, visit

financial. thomsonreuters.com/corporate-treasuryactually required at inception

(only the goodwill of the

initial capital is registered),

so the paperwork for setting

up an office in a free trade

zone can be completed before

payment is made. If your

company has other entities

in China, it should consider

establishing a holding

company in a free trade zone.

Payments in free trade zones

are usually made in renminbi.

Your choice of free trade

zone will depend on the

industry in which you

operate (different zones have

specialist industries), your

geographical focus (both in

China and the surrounding

countries/territories) and

any operations you may have

already located in China.

For more information on

free trade zones, visit

www.shanghaifreetradezone.org/en/index.htm

Or view the ACT webinar,

Exploring the impact of free trade reform in China,sponsored by Thomson

Reuters, at

www.treasurers.org/freetradereform

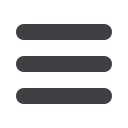

WHAT DOES IT MEAN FOR PRIVATE BUSINESSES?

China

Shenzhen

(PFTZ)

Shanghai

(PFTZ)

Hong Kong

Interest rate

6%

5%+

5%+

5%+

Corporation tax rate

25%

15%

25%

15%

Individual tax rate

3%-45% 3%-45%

45%

15%

VAT

13%-17%

Renminbi trading

Yes

Yes

Yes

No

Can the initial

capital injection

be returned?

No

Yes

Yes

Yes

IAFEI Quarterly | Issue 29 | 6