Press, Journal Article

43

I

nvestors feel like Alice when she tumbled down the rabbit hole

into Wonderland. Except instead of encountering talking rab-

bits, incorporeal cats, and time that can run backwards, investors find

themselves in a land where they must pay a bank for the right to hold

a deposit and the bank pays them to take out a loan.

At least that’s how it seems in our world where five global central

banks have imposed

negative

interest rate policy (NIRP) (see

Figure

1

below). The NIRP brigade includes the European Central Bank

(ECB), the Swiss National Bank (SNB), Sweden’s Riksbank, Den-

mark’s NationalBank, and, most recently, the Bank of Japan (BoJ).

Unlike Alice, you may not soon wake from this bad dream. It’s reality.

Worse, we were told by our professors that negative inter-

est rates were impossible, sort of like how it’s impossible to ex-

ceed the speed of light in space travel (see

Did You Know

on the next page). Since “zero” appears to no longer bind,

how can we make sense of this new world?

As we will argue, upon closer inspection, the innovative policy is not

all that innovative. The effective lower bound may just be a little lower

than previously assumed due to financial frictions. Central banks,

meantime, are still pursuing the same strategies as before: attempt-

ing to induce spending and investment by lowering interest rates.

1

M onetary P olicy U nmasked:

O ur T ake on

N egative I nterest R ates

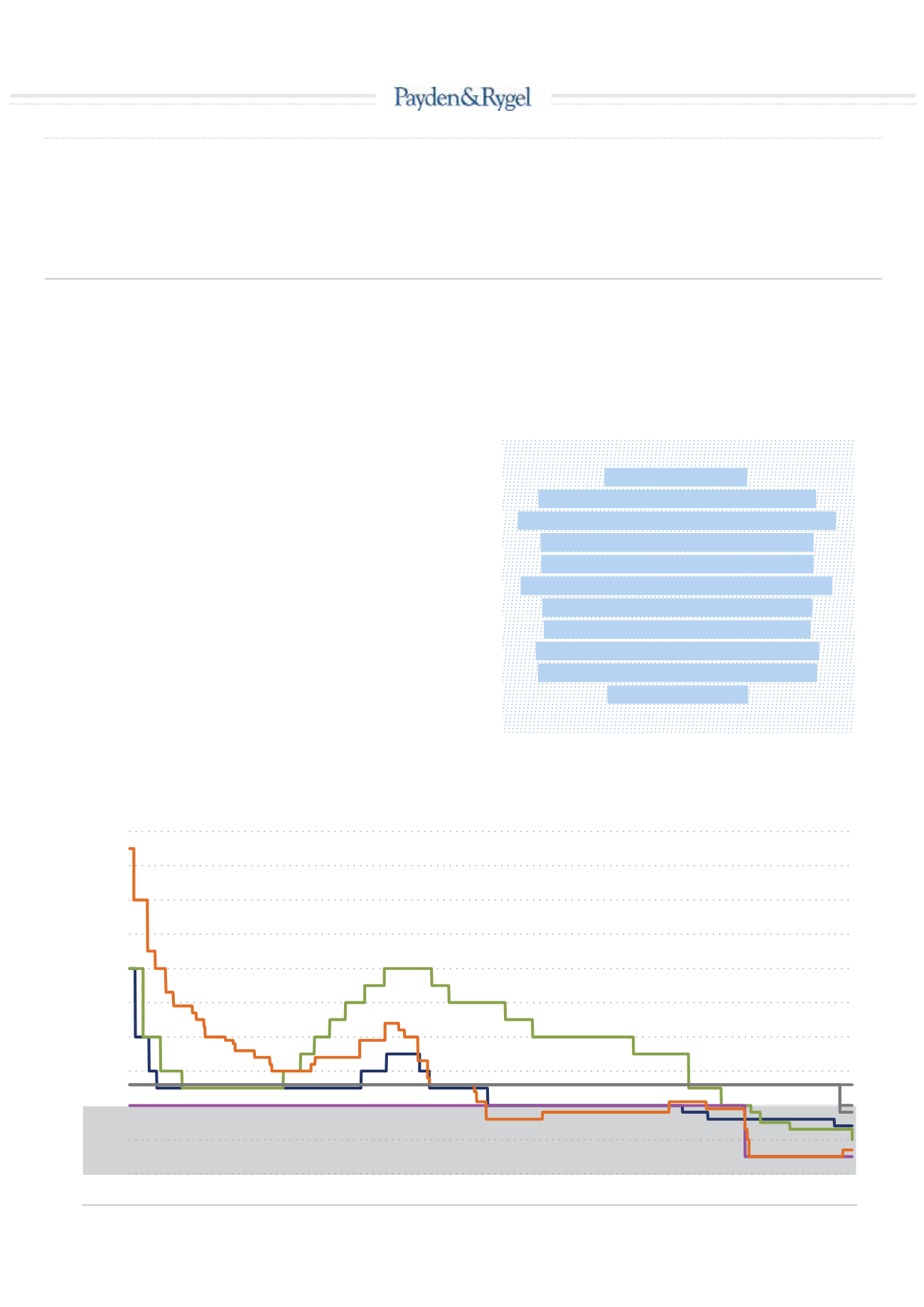

WELCOME TO THE NEGATIVE INTEREST RATE POLICY (NIRP) ZONE:

FIVE GLOBAL CENTRAL BANK POLICY RATES ARE NOW BELOW THE ZERO LOWER BOUND (ZLB)

fig. 1

-1.0%

-0.5%

0.0%

0.5%

1.0%

1.5%

2.0%

2.5%

3.0%

3.5%

4.0%

2009

2010

2011

2012

2013

2014

2015

2016

% Yield

“NIRP” ZONE

ECB: Overnight Deposit Facility

Denmark: One-Week Certificate of Deposit

Sweden: One-week Debt Certificates

Switzerland: Overnight Sight Deposit

Japan: Policy-Rate Balance Rate*

*On Jan. 29, 2016 the Bank of Japan put in place a three tiered structure of rates, with one of their policy rates being negative (-0.10%)

Source: Bank for International Settlements

«INSTEAD OF

ENCOUNTERING TALKING

RABBITS, INCORPOREAL CATS,

AND TIME THAT CAN RUN

BACKWARDS, INVESTORS

FIND THEMSELVES IN A LAND

WHERE THEY MUST PAY A

BANK FOR THE RIGHT TO

HOLD A DEPOSIT AND THE

BANK PAYS THEM TO TAKE

OUT A LOAN»