Press, Journal Article

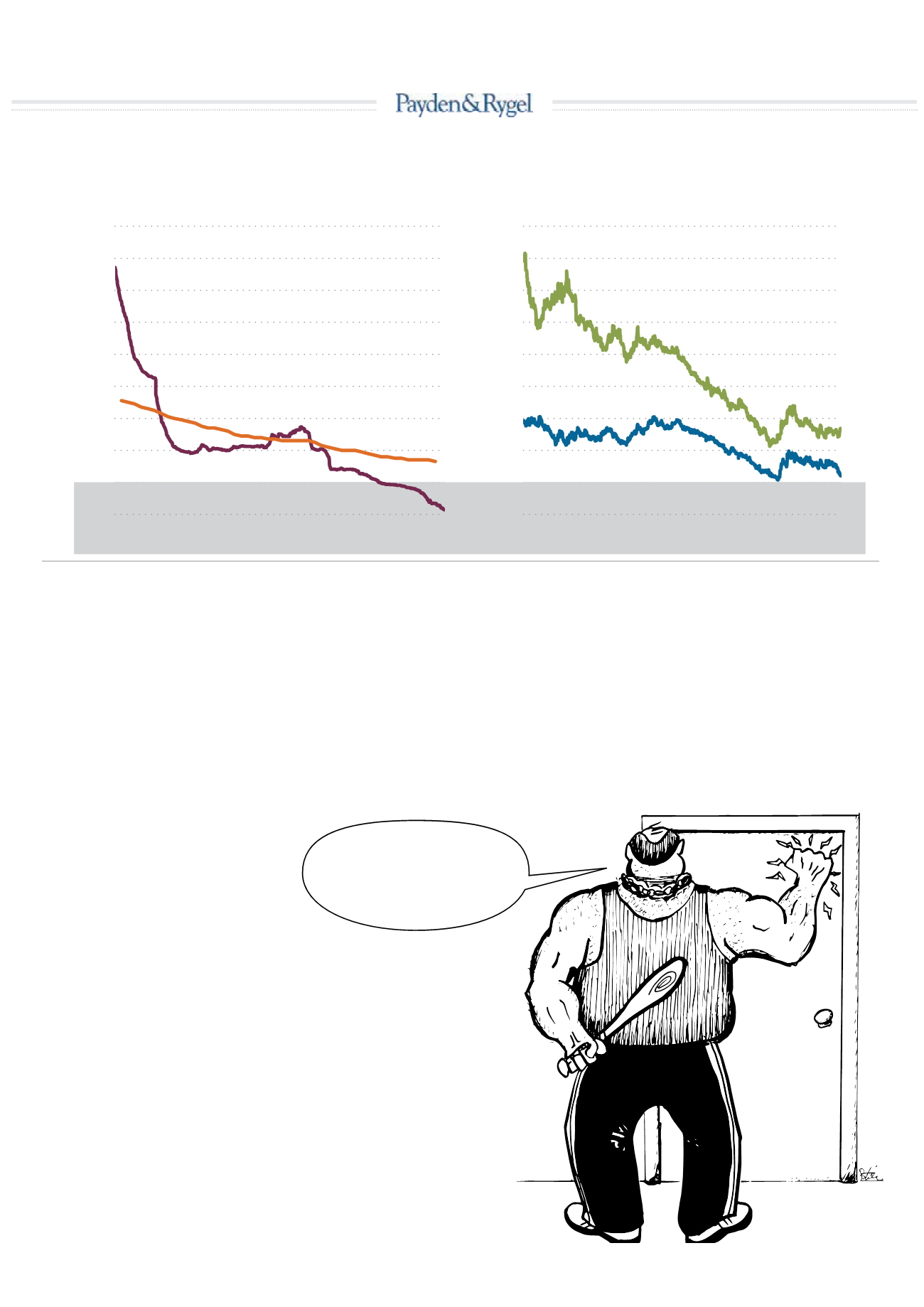

Second, beyond central bank deposits and “safe assets,” in the euro

area, for example, household deposit rates are low but still positive

(see

Figure 2

above), meaning NIRP has yet to hit retail investors and

savers. When it does, we think savers will respond and seek out alter-

natives.

HOW LOW CAN THEY GO? IT’S UNKNOWN

So how low can

nominal

interest rates go? It’s unknown. Federal Re-

serve staff concluded in 2010 that negative rates

below -0.35% would trigger currency

hoarding among the American popu-

lation. Both the Swedish Riksbank

and SNB’s negative rate regimes have

exceeded that rate for sometime. The

ECB’s deposit rate just dipped to -0.4%.

In the short run, NIRP could go further still. Put yourself in the shoes

of a saver facing the prospect of a negative rate.What steps would you

take?

First, you could liquidate your bank account. If you withdrew a stack

of 1 million US dollars comprised of only $100 bills, your loot would

weigh 22 pounds and tower nearly 4 feet high. You’d need a large piece

of luggage to haul the cash home from the local bank branch and

probably require an entire room—or at least a large walk-in closet—

in your house for storage.

But, your problems wouldn’t end there. You’d have to hire someone to

keep an eye on the cash, count it, organize it, and insure it. It would be

subject to fire, flooding, environmental degradation. For the average

person’s wealth, this wouldn’t be much of a hassle. For anyone with a

substantial stash of cash, the problems would mount.

Not quite vault-ready with the size of your savings? You could pur-

chase gift cards as a way to “store value” (but then you are an unse-

cured creditor to a retailer). You could store value in non-cash, non-

3

STILL FLOATING ABOVE? BOTH LONG-TERM AND SHORT-TERM RATES HAVE FALLEN IN THE EUROZONE, BUT

HOUSEHOLD DEPOSIT RATES ARE STILL ABOVE ZERO

fig. 2

“NIRP” ZONE

-1.0%

0.0%

1.0%

2.0%

3.0%

4.0%

5.0%

6.0%

7.0%

8.0%

2012

2013

2014

2015

2016

LONG-TERM INTEREST RATES

-0.2%

0.0%

0.2%

0.4%

0.6%

0.8%

1.0%

1.2%

1.4%

1.6%

2012

2013

2014

2015

2016

SHORT-TERM INTEREST RATES

European household deposit rate

Three-month Eurolibor

Germany 10-Year

Italy 10-Year

Source: Bank for International Settlements

% Yield

I'M GONNA MAKE YOU AN

OFFER YOU CAN'T REFUSE.

DO NOT PAY THAT

LOAN EARLY!

45