No, I do not believe this. More decisive probably is that

the analysts basically have a more positive evaluation of

the Fraport Group. At this, especially the new evaluation

of the traffic chances at the site Frankfurt are playing a

role. After the disappointment with the small minus in

2016 as to the passenger numbers, one now recognizes

the chance for a significantly higher growth, underlined

by the announcements of existing and new airlines.

The interview was made by Lisa Schmelzer and Peter

Olsen.

About the person: Professional Optimist

Dr.

Matthias Zieschang

is unpertubed not so easily.

Whether it the delay of the take over of the 14 Greek

airports, whether its failures at airport auctions, whether

it is the permanent dispute with the Philipines about the

damage compensation payments requested by Fraport,

or whether it is the dispute with Lufthansa and Co.

concerning the incentives offered to new airlines at the

Frankfurt Airport – the doctored business theoretician

remains relaxed and has the view forward.

Since 2007 the now 56-year-old is responsible for the

finances of the airport operator, his job contract has been

extended by further 5 years still 2022. Together with CEO

Dr. Stefan Schulte the professional optimist so far has

also convinced the capital market. The loss of Antalya

as a profit contributor in 2016 has been compensated

by payments from Manila and by divestment revenues

from the partial participation sale of the St. Petersburg

Airport more than enough.

From Börsenzeitung, Frankfurt am Main, Germany,

May3, 2017. Responsible for English translation: GEFIU,

the Association of Chief Financial Officers Germany,

translator: Helmut Schnabel

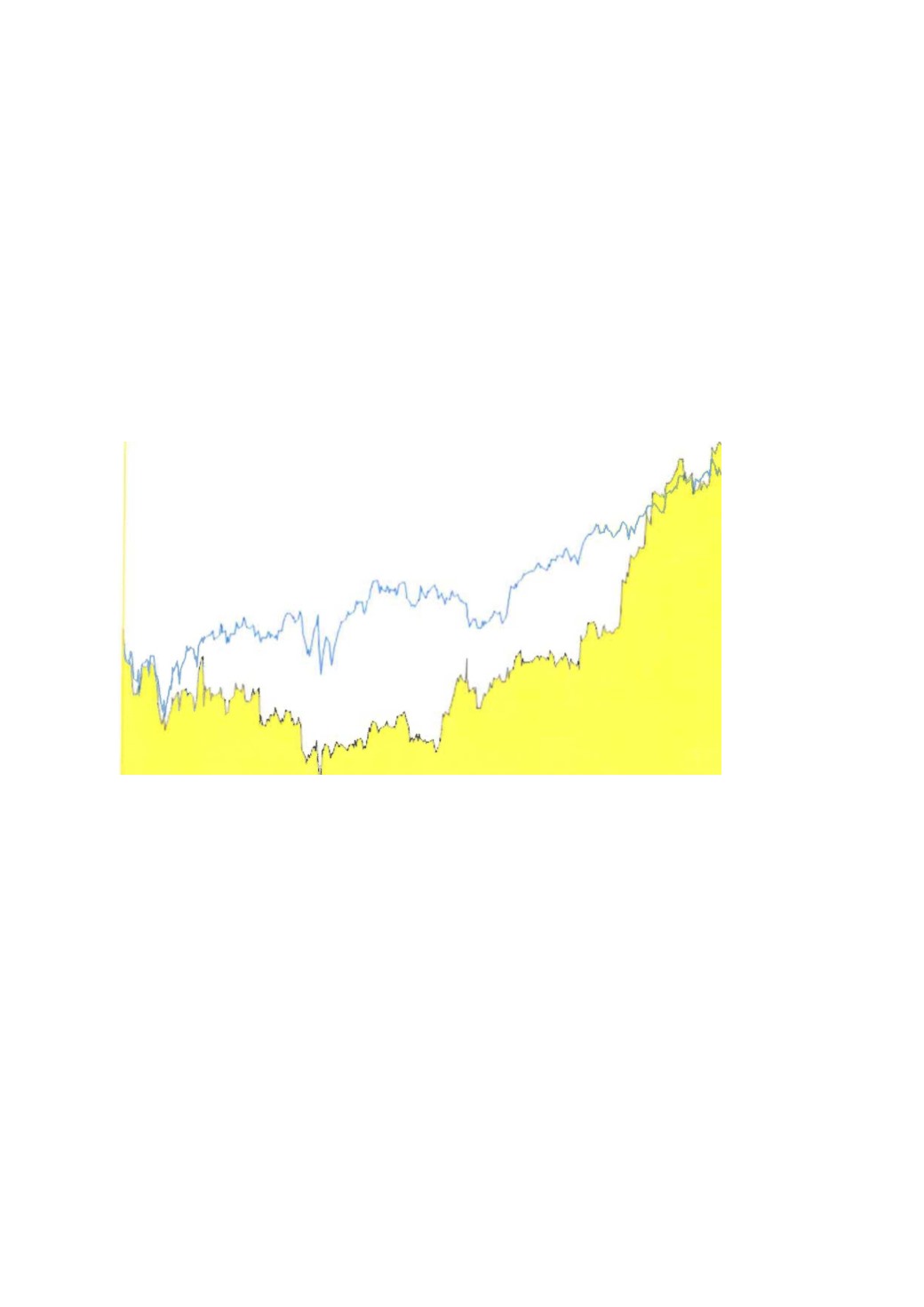

Fraport AG 78,39 Euro Share Price as of July 14, 2017,

German Stock Exchange Xetra

Index Price Chart, Index-base as of January 4, 2016 100

-Upper black line:

Fraport AG Share

-Lower blue line:

MDAX German 50 Companies Mid Cap Stock

Index

04.01.2016 - Kurs: 100

130%

12.0

%

110%

100%

90%

80%

2017

20