has elaborated the budget for the ongoing year and

with a view to the year 2020. For this, for example,

we are looking at what this means for the individual

divisions, where something must happen as regards

future growth, the margin and eventually the cost basis.

Thereby, we are creating transparency. Then we can see

whether we still continue on the road for success. In

addition, we are preparing for capital expenditure and

we are evaluating the profitability and whether it is

matching with our objectives.

Why are the earnings per share such an important

number for you?

It shows to the shareholder what he is earning at the

end. Especially for the American investors this is very

decisive. Still, one third of our share capital is in the

hands of Anglo-American shareholders. This we want to

regard well. The objective is clear: Until 2020 we want

to double the earnings per share from lately 2.50 Euro.

What differentiates your investors from European ones?

American investors are very heavily focused on quarterly

numbers, in Europe this is not so marked. Typically,

Americans have a strong interest in technology and

often they understand it very well.

Is it easier in the USA to explain the strategy of

OSRAM?

Not really, but some investors are more interested and

have good ideas for us and, for example, are proposing

new applications for our products or are proposing

corporations for cooperation. These are good advices

from which we benefit.

As regards the information of the capital market,

OSRAM had to catch up, as the breakdown of the stock

price in autumn 2015 has shown as a reaction to the

new strategy. How would you have approached this?

It is useless to speculate about the past. I was not a part

of it, and therefore I cannot say much about it.

Osram at a glance

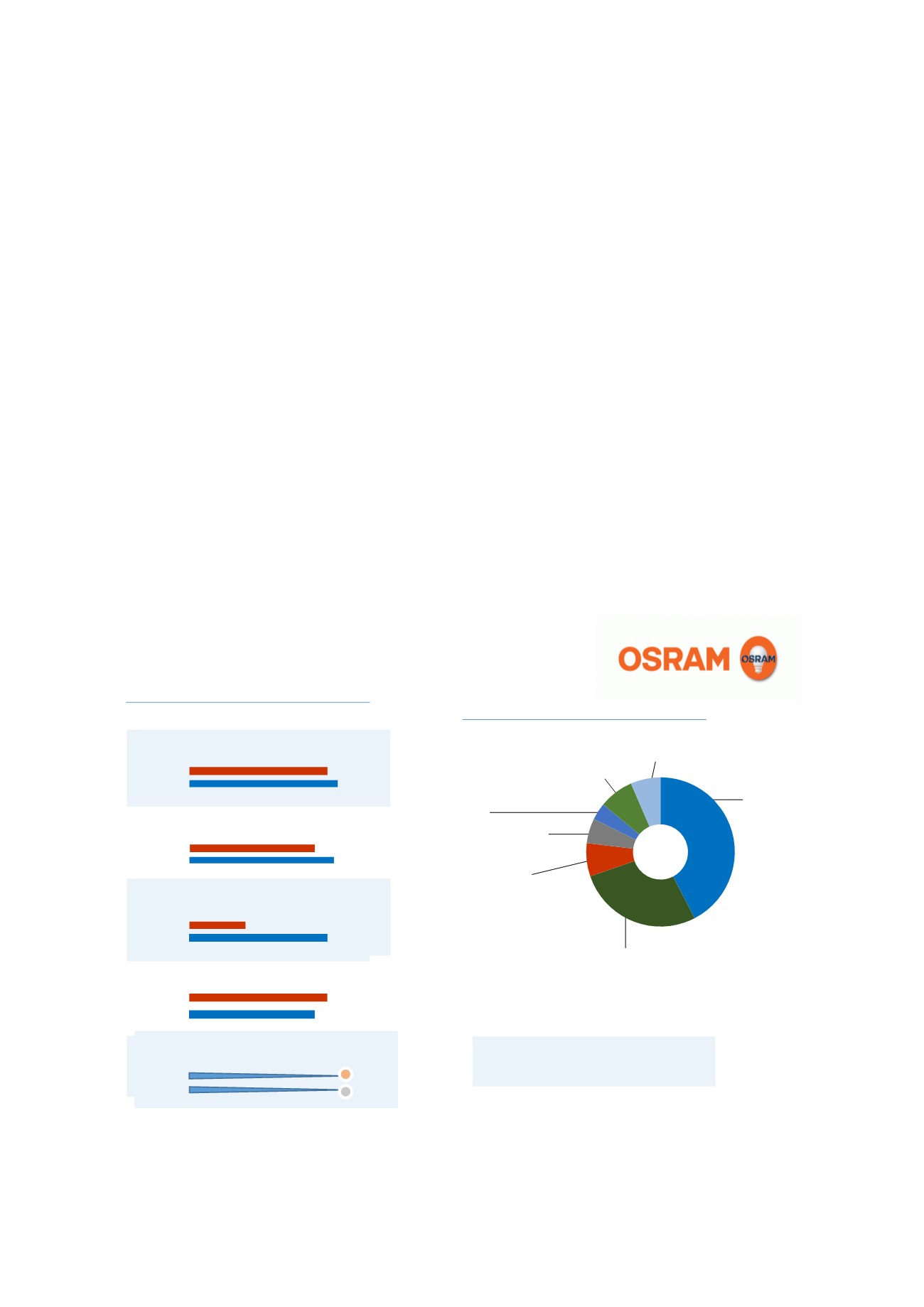

Sales

in million Euro

2014/15

2015/16

3572

3785

Ebita**

in million Euro

2014/15

2015/16

363

440

Net Profit

in million Euro

2014/15

2015/16

228

532

Operating Cash Flow

in million Euro

2014/15

2015/16

390

373

* Continued business without Ledvance, business year ends

September 30

** Earnings before interest, taxes and goodwill depreciation

Osram Group Numbers*

Equity Ratio

in percent

2014/15

2015/16

52

52

Institutional and strategic Shareholders

France

7,2 %

Norway

3,7 %

Market capitalization

Status July 14, 2017

7.5 billion Euro

Source: Corporation, Thomson Reuters

Germany

42,4 %

UK

5,4 %

Others

6,5 %

USA

27,3 %

therein Siemens

17,5 %

Rest of Europe

7,5 %

Status December 31, 2016; institutional Investors are holding over

80 % of share capital

22