indications of shortages of both management talent

and skilled jobs such as diesel mechanics, tech

engineers, and sales and service positions.

Other top concerns include health care costs, which

are expected to increase by more than 7 percent over

the next year; Washington gridlock and, for the first

time as a top 5 concern, data security.

Table 1: During the past quarter, which items have

7

Global results

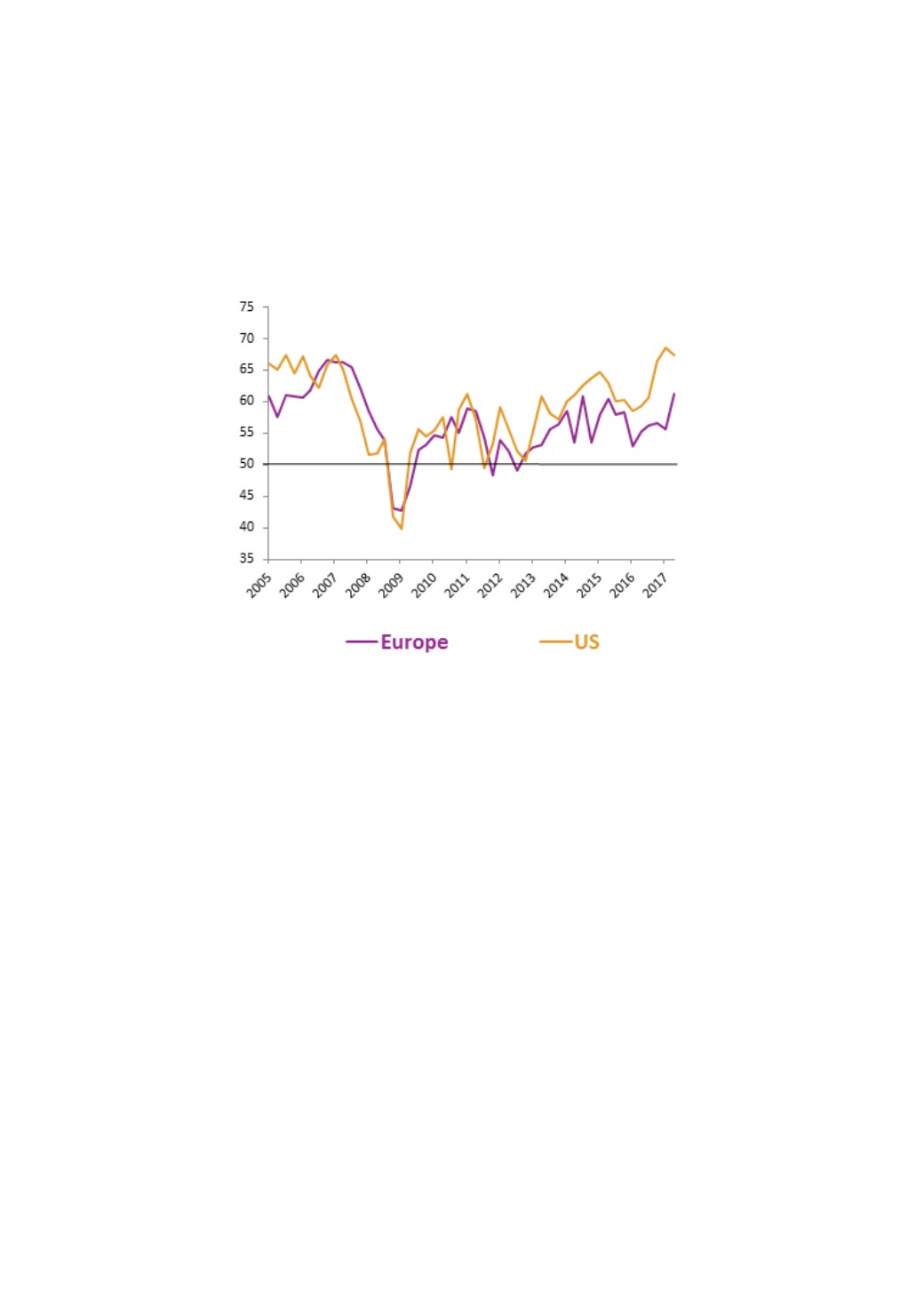

Optimism is up in Europe, especially in France, only

a notch below U.S. optimism. Capital spending will

strengthen and moderate employment growth (1.7

percent) is expected. Top concerns include economic

uncertainty, attracting and retaining qualified

employees, followed by governmental regulations and

policies.

About one in five companies say they are delaying

expansion due to uncertainty about regulation and

the economy. Shortage of funding and of qualified

employees limits the ability to pursue certain value-

creating projects (in addition to too much uncertainty

about some projects and these projects not being core

to the firm).

Optimism is up in Asia, nearly as high as in the U.S.

Difficulty attracting employees, currency risk, and

falling employee productivity are top concerns. Five

percent capital spending and 2.7 percent employment

growth expected. About one-third of firms say

uncertainty about economic growth and tax policy are

greater than normal but few Asian firms are slowing

expansion plans in response. Too much uncertainty

and overly optimistic projections are primary reasons

that some value-creating projects are not always

pursued (in addition risk being too high and the project

not being core to the firm’s strategies).

Latin American CFOs have moderate optimism, up from

very low levels one year ago. After dropping 6 months

ago, Mexican optimism has almost fully recovered.

Still, there are significant concerns about economic

uncertainty and weak demand.

Business optimism in Africa is the lowest in the

world. Employment outlook is weak. Biggest concerns

are economic uncertainty, volatility of the political

situation, and governmental policies.

Fifty-five percent say that uncertainty is worse than

normal, and among these firms more than half are

holding off on expansion in response. Shortage of

funding limits ability to pursue value-creating projects

(in addition to projects not being core to the firm and

scarcity of management time).