Interviews

The further investment into the plant of our subsidiary

Saltigo is presently the most prominent project. Further

options we are presently investigating. First of all it is about

extensions of existing plants and not necessarily about the

building of new plants. But we are not in a hurry. This also

relates to acquisitions. The capital expenditure into the

organic growth we are stretching over the next three to

four years.

Are you sure, that there is no hurry as to acquisitions? The

consolidation of the industry of chemicals is indeed in full

swing.

On the one hand the consolidation is happening, on the

other hand, however, there are also business areas, which

are being de-consolidated or de-merged. Also in the

last ten years, there have again and again business units

been offered in the market. Because of up to now our

tense financial situation, we could not at all until recently

participate in this process. This is now different. But at

the end of the day it is all about creating added value.

Therefore we do not let ourselves been hasted at M & A

transactions, also given the fact, that we have just about

announced an acquisition of the hygiene and disinfection

business of Chemours. We have achieved in the past 18

months to deleverage the corporation group, to adapt the

group structures, to get the cash flow again flowing, and

to bring our synthetic business into a joint venture, and to

initiate an acquisition. We have thus performed a lot in a

short time.

When today an attractive business is put up for sale, then

it will certainly not be available any more in six months.

We are putting ourselves, very consciously, not into a

position in which we have to carry out an acquisition at

the time of X. It is important, that it fits strategically and

financially. Then we shall also be in a position, to act

quickly, as one can see at the example of Chemours.

Your fine chemicals subsidiary is a “prolonged work

bench” of the agrochemical groups. What does mean the

just ongoing consolidation in this industry - Chemchina

acquires Syngenta, Bayer is courtingMonsanto, and from

the merger of Dupont and Dow Chemical results another

large agrochemical group - for Saltigo?

This we regard as neutral to positive for our business.

Especially in the case of Dupont and Dow Chemical there

will certainly result also new chances for strong supplier

producers like us. In total, the consolidation is showing that

all players regard the segment as a growth market. And we

share this view.

You have announced, to reduce the rating – relevant

financial debt by 400 mio €. If one looks at what Bayer

is ready to pay for Monsanto, one could mean, that debt

ratios today are not any longer so important. What is

your view on this?

We have a slogan, which we apply since the first day of the

existence of Lanxess: We want to have an investment grade

Rating. This is also not changing by way of that actually there

is much liquidity in the markets, and by that also corporations

with weaker Rating grades have good access to liquidity. It

is just about seven years, since when it has been difficult for

corporations with investment grade Ratings, to get liquidity at

all.Atthetimewewerereallyglad,tohaveaninvestmentgrade

Rating.

Do you have a concrete target Rating within the investment

grade?

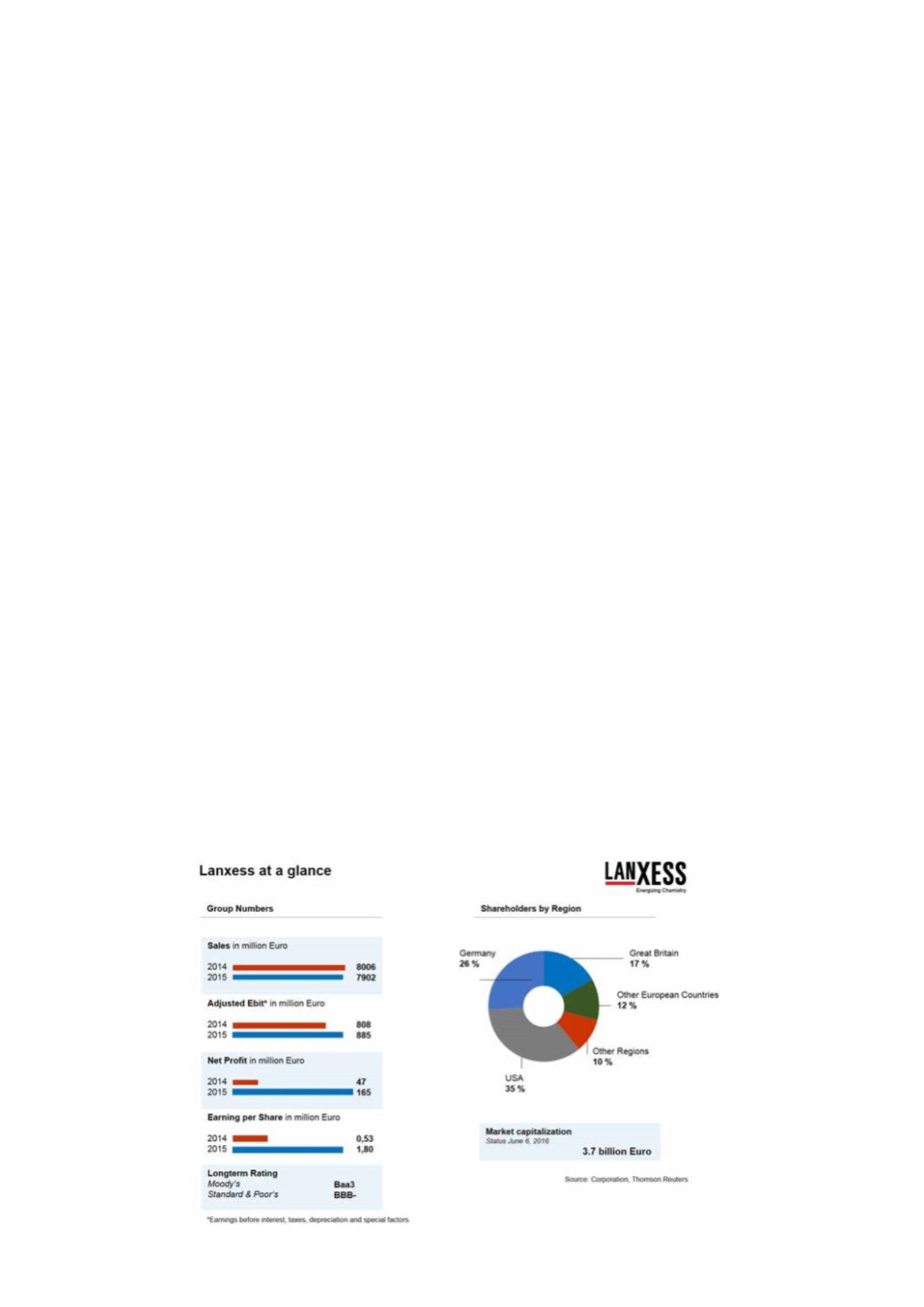

Today we are valued with BBB-, and we are thus on the

14