Press, Journal Article

2

2

PRICE POINT

2

and, of course, the significant impact of slowing economic growth in China. The negative impact of these

macroeconomic influences on Asian economies has been reflected in a protracted period of weak corporate

earnings growth exacerbated by a combination of overinvestment, excessive leverage, and poor management

discipline. Amid such an environment, company margins have been progressively squeezed, and returns on

capital have declined. In order to see gains in Asia, this contraction needs to reverse, with expanding margins,

improved returns on equity, and, ultimately, a positive rerating of Asian equities.

Margin expansion can be driven by various means; from topline growth (as a result of innovation or product

premiumization) to a more disciplined approach to reducing costs (due to lower wages, falling raw material costs,

or simply greater management focus). In addition, more disciplined capital spending should aid margins and

improve returns on capital. We are beginning to see some evidence of this kind of margin improvement coming

through in the Asia ex Japan region, potentially signaling a market inflection point following an extended period of

disappointing earnings growth and downward revisions.

A LESSON FROM HISTORY

For a long time, too many Asian companies ignored margins, enjoying the benefits of rising topline revenues.

Looking back, it is not so difficult to trace the path that led to many of the challenges facing Asian companies

today. In the years following the Asian market crises of 1997

2002, companies in the region embarked on a

spending spree, effectively playing catch-up after years of underinvestment. Encouraged by greater stability in the

region, rising foreign investment, and resurgent economic growth, companies initiated massive investment

programs aimed at boosting productivity and sales. As such, a lot of the earnings growth of the past has been

achieved by expanding sales in an environment of robust economic growth. Asia also enjoyed a rapid recovery

after the global financial crisis of 2008, allowing old habits to persist, and it was not until Asian economic growth

began to slow from 2011 that the results of this behavior began to show. In the rush to spend, history shows us

that much of this was poorly invested by ill-disciplined and overexuberant management teams and often financed

by mispriced capital. The result of this irrational spending was supply gluts, excess inventory, overcapacity, and,

ultimately, falling prices and contracting margins. Today, companies are finally adjusting to the new economic

reality, with management teams modifying their practices to account for the tougher environment in which they

are now operating.

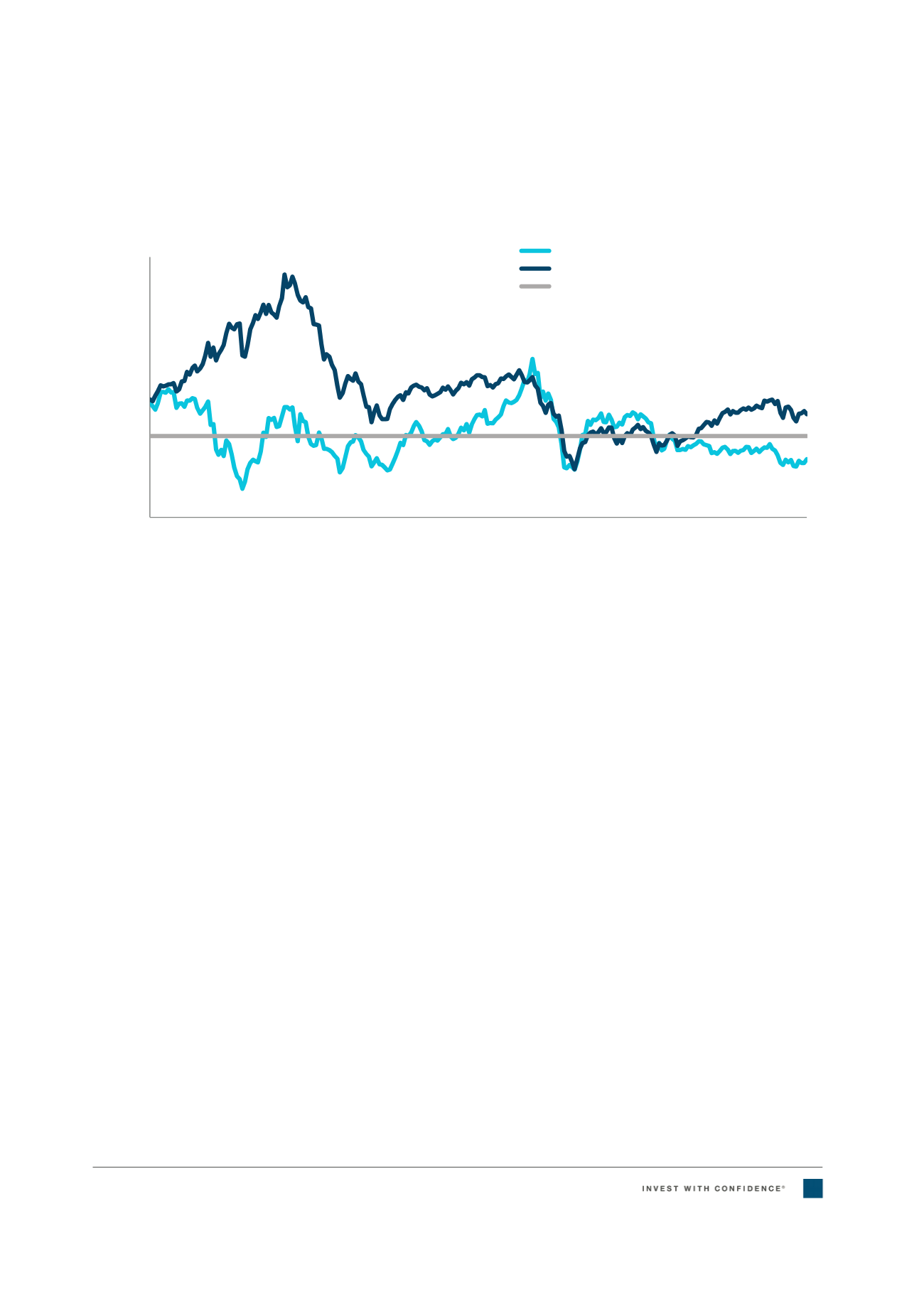

Figure 1:

Asia ex Japan valuations are at historically cheap levels

As of June 30, 2016

Sources: FactSet and Thomson Reuters.

0.5

1.0

1.5

2.0

2.5

3.0

3.5

4.0

4.5

1995 1997 1999 2001 2003 2005 2007 2009 2011 2013 2015

P/B LTM (x)

MSCI AC Asia ex Japan

MSCI The World Index

MSCI AC Asia ex Japan Long-Term Average

41