Press, Journal Article

3

3

PRICE POINT

3

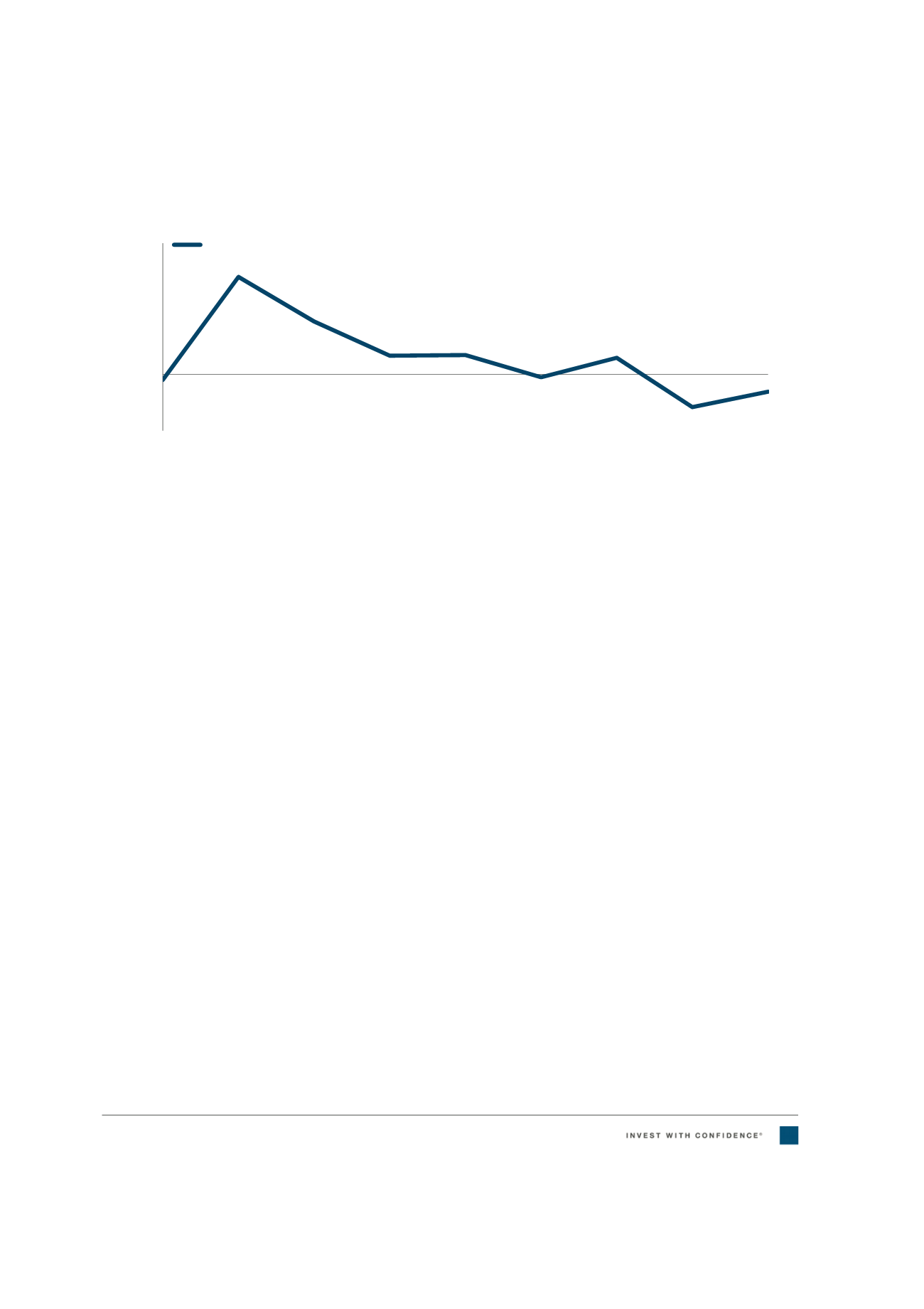

CAPITAL EXPENDITURE (CAPAX) DISCIPLINE COMING THROUGH

One area where this has been particularly evident is in the way company management teams are allocating

capital. Greater discipline in relation to capex—the amount spent on maintaining/expanding the asset base—

should have a material impact on the amount of free cash flow that Asian companies are generating (Figure 2).

This is important because cash flow allows a company to pursue opportunities that enhance shareholder

value. Without cash, it is tough for a company to develop new products, make acquisitions, pay dividends,

or reduce debt.

LOWER COSTS ALSO BODE WELL FOR MARGIN IMPROVEMENT

Furthermore, profit margins in Asia have also been under pressure in recent years as wage growth has outpaced

growth in productivity. This has been particularly evident in China. However, for the first time in five years in Asia,

we are beginning to see wage growth moderate toward more sustainable levels. This reduction in wage-related

costs should provide a positive influence on company profit margins. At the same time, lower commodity prices,

particularly for energy, is also materially beneficial as lower raw material input costs again flow through to provide

a boost for corporate profit margins. These are natural, cyclical factors that impact margins, but selectively across

Asia, especially at the higher-quality, private sector companies within our region, we are seeing evidence that

management teams are taking a more disciplined approach to managing their cost base. Companies are also

realizing that they can no longer rely purely on economic growth to drive their revenues. Companies that succeed

in introducing new products to drive their topline while managing costs effectively should deliver solid growth over

time. This type of “self-help” is an important factor we look for through our research process.

Given the recent history of weak earnings growth and returns on capital from Asian equities, the current valuation

levels are not entirely unjustified. However, signs of improvement are emerging, potentially signaling an inflection

point in the market. Reduced costs are beginning to flow through to expanding company margins, while greater

capex discipline is likely to lead to improved return on capital, as well as allowing companies to potentially return

more cash to shareholders via dividends or by buying back shares. Investors will most likely be prepared to pay

for the prospect of greater capital returns, leading to a potential positive rerating of the Asian equity market.

Figure 2:

Management showing greater discipline in relation to capex

As of December 31, 2015

Sources: FactSet and Thomson Reuters. Capex growth per calendar year (CY). Estimated for 2016

2017.

-15%

-5%

5%

15%

25%

35%

2009

2010

2011

2012

2013

2014

2015

2016E 2017E

MSCI AC Asia ex Japan

One-Year Capex Growth (%)

42