Press, Journal Article

2

2

PRICE POINT

2

Our base case, therefore, is for a managed,

gradual devaluation of the renminbi this year

and for authorities to re-build confidence in

the currency. But it’s certainly possible to

envisage more disruptive outcomes.

THE ECONOMY

It was inevitable that China’s economy—

the

world’s

second largest

—

would slow from the

double

–

digit growth attained over previous

decades, particularly with the government

attempting to transition the economy from one

led by manufacturing, investment, and exports

to one more driven by domestic consumption

and services.

Nevertheless, the slower pace of growth

along with mounting concerns whether

China’s leaders can effe

ctively manage this

transition have sent tremors through global

emerging markets several times over the

past three years

—

with fears now impacting

developed markets as well.

The government’s recent heavy

-handed intervention aimed at supporting its equity markets and currency, and its

inconsistent communications, have undermined

investors’ confidence in China’s leadership and spurred more

capital outflows from the country.

The Chinese government recently reaffirmed its expectation for economic growth to average 6.5% per year

between now and 2020. We consider that to be difficult to achieve without also seeing some undesirable

consequences.

While the risk of policy mistakes remains high and should be closely monitored, we don’t believe that a hard

landing for China is the most likely outcome. Policy

makers have every incentive to ensure that doesn’t happen;

their very existence probably depends on it.

Several options, including the use of monetary and fiscal policy, are likely to be used to support growth and

smooth the transition. Even if China grows at 6.3% this year as the International Monetary Fund forecasts, that is

still a very impressive rate in the context of global growth.

THE DEBT BUBBLE AND FINANCIAL CRISIS

China has experienced a massive buildup of debt since the 2008 financial crisis and a significant rise in

nonperforming assets in its banking system.

We believe that the level of nonperforming loans in China is substantially higher than the 1.5% rate reported by

the central bank. China’s banking stocks have been trading at valuations that would indicate a nonperforming loan

rate of about 6%. If China were to suddenly recognize all of those nonperforming assets, it could prove highly

disruptive to the economy and could trigger a financial crisis at some point. But we think that outcome is

extremely unlikely given China’s government control of the banking system and the financial s

ystem more

broadly.

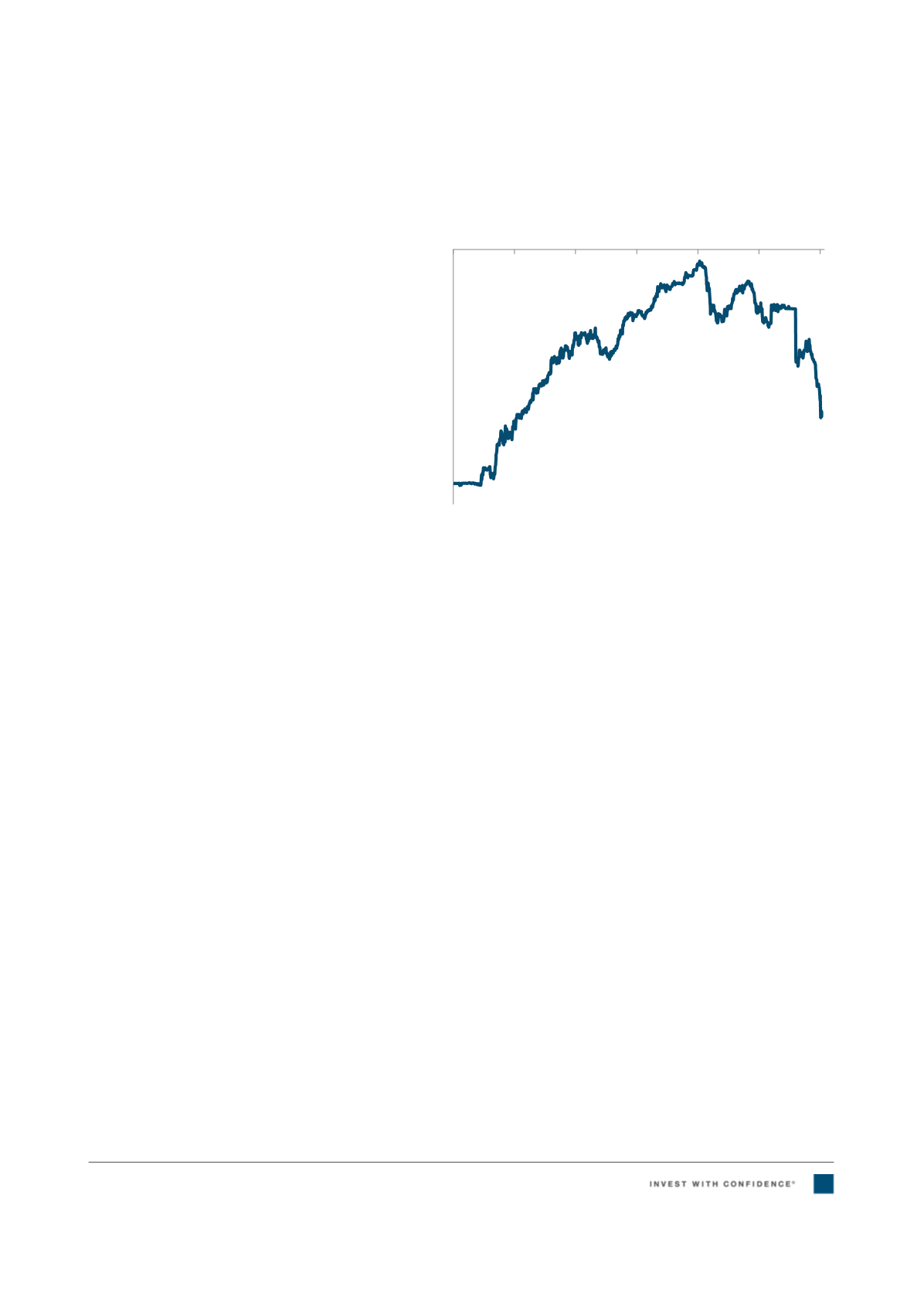

Figure 1:

Chinese Yuan in One U.S. Dollar

Inverted scale to show decline in yuan

Source: Bloomberg. As of January 2016

6.0

6.1

6.2

6.3

6.4

6.5

6.6

6.7

6.8

6.9

2010 2011 2012 2013 2014 2015 2016

A Declining Currency

30