International Working Committees

This question raised the interest of some CFOs who for

instance recommend as follows: «If no amortisation

reintroduction will be possible, then are absolutely

important: a) standardisation of mechanism on

WACC, g rate and other parameters; b) possibility to

reaccount an impaired goodwill in front to different

economics conditions; 3) impose very mandatorily

all the sensitivities to be done and to be reported

in the disclosures», or suggest that the relevance of

benchmarks and specialized firms, or the need of

standardised test methods considering also the capital

market valuation practice or another that firmly states

as follows: «I believe the current approach is the best

even though it introduces subjectivity».

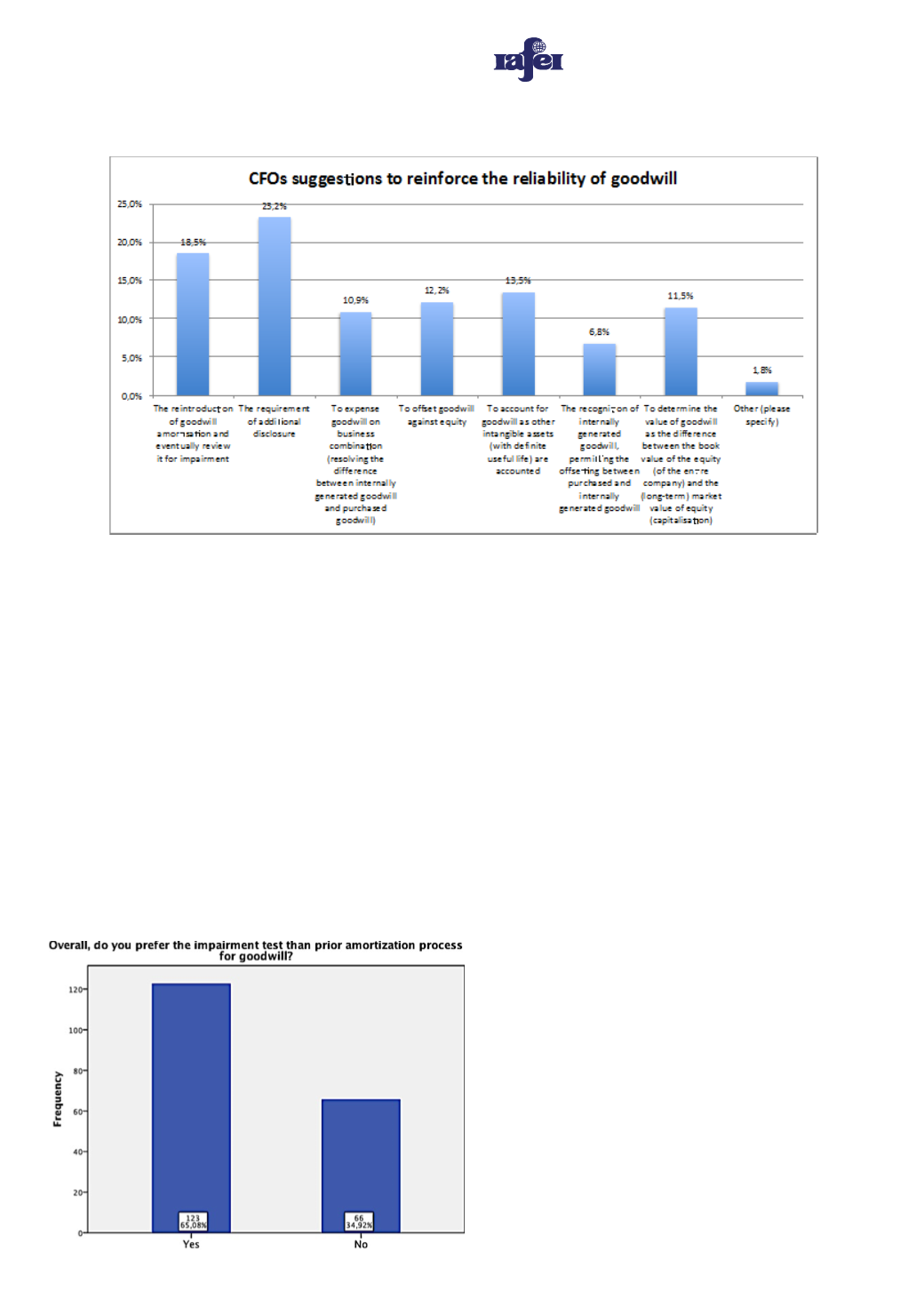

Purposely, the questionnaire concludes by asking CFOs

their overall preference between the impairment test

and the amortization process and more than 65% of the

respondent CFOs prefer the impairment test.

Discussion

The conclusive question on the CFOs preference

between the impairment test and the amortization of

goodwill directly answers to the EFRAG recent debate on

a possible reintroduction of the goodwill amortization.

Although the difficulties underlined to implement the

test, the 65% of the respondents prefer the impairment

of goodwill. However, the remaining 35% still prefer the

amortization process.

We conclude this report with some of the CFOs

suggestions and recommendations, which might

constitute the case for future investigation. Interestingly

a CFO suggests to «review/propose impairment test

methods/tools», hence future accounting studies

might create a tool to assess the effectiveness of the

impairment test.

On the other hand, another CFO points out how actually

in liquid and transparent markets the market operators

are sufficiently prepared to estimate fair value estimates

and that they can adjust their expected cash flows,

the fall in the share price as a consequence advances

the recognition of the impairment losses. This CFO

expresses as follows: «My sense is share price falls after

impairment write downs are more sentiment driven and

a reflection on the ability of the relevant management to

communicate future direction. After all, an impairment

is a correction of a past action (an acquisition) and if the

market assesses the acquisition won’t justify the price

paid (i.e. the company has overpaid), it will adjust the

share price immediately and not wait for a subsequent

impairment». However, we then could ask (as a future

research question): does the market anticipate or react

to goodwill write-offs?

27