International Working Committees

CFOs are concerned about both of them (about 49.3%

and 40.3% agree).

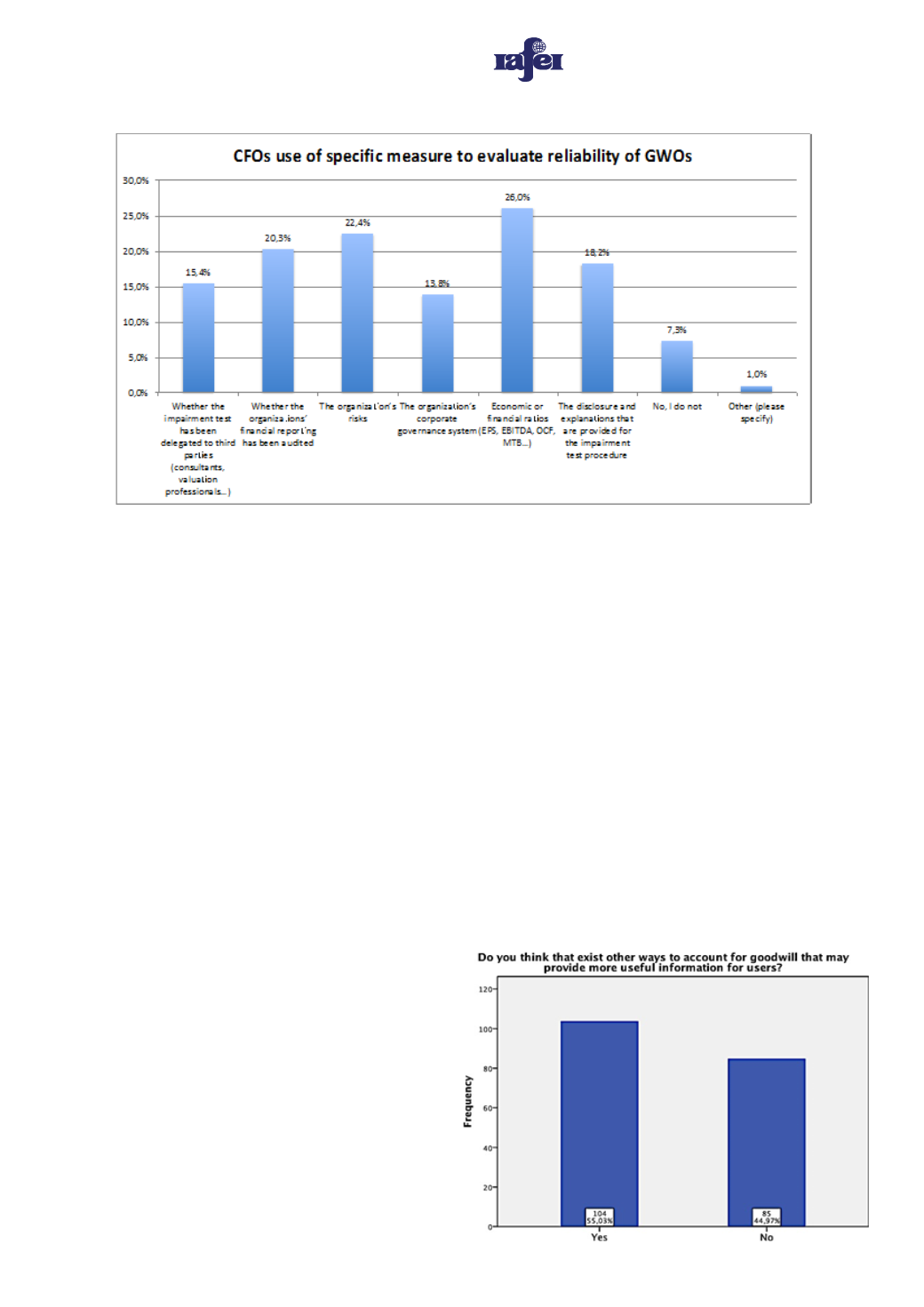

Do CFOs use specific measures/procedures to evaluate

the overall reliability of goodwill impairment test?

About 26% of CFOs use economic or financial ratios,

22% evaluate the organization risks and about the 20%

takes into account whether the financial report has

been audited. Significantly important is considered by

about 18% of the respondents also the disclosure and

explanations provided for the impairment, while the

15% take into account whether the impairment test

has been delegated to third parties and the 14% the

company corporate governance system. We did not

expect that the 7% do not use any specific measures

or procedures to check the reliability of the process.

A CFO than specified that he (or she) uses the historic

performance of the cash generating unit while another

revealed to use the sensitivity analysis disclosed.

Do CFOs compare their evaluation with other

evaluation(s) of subjects in other positions?

Again, we did not expect that so many respondents do

not compare their evaluation with the evaluation(s)

of other subjects (20.6%), this result may contribute

to the behavioural studies on the top-executives

overconfidence. Although, 15.6% of the participants

admit to compare their evaluation with those of the

controller, 9.9% with those of the internal auditor, 8.3%

with those of the process owner and with those of the

risk managers and 6.0% with those of the compliance

officer.

Which is, at the end, CFOs opinion on the current

accounting method for goodwill?

It is relevant that more than half of the respondent

CFOs (55%) is convinced that there are other accounting

treatments for goodwill, which might better fulfil the

information usefulness objective of financial reporting.

More than 23% of CFOs suggest the requirement of

additional disclosure. Awidepercentage (18.5%) believes

also that the reintroduction of goodwill amortization

and its eventual review for impairment might solve the

reliability issues. We can see that also accounting for

goodwill as other intangibles (with definite useful life)

is perceived as a good solution (13.5%) as well as to

offset goodwill against equity (12.2%) or to expense it

on business combination (10.9%) or to determine the

value of goodwill as the difference between the book

value of the equity and the long-term market value of

equity (11.5%). A part of the participants (6.8%) believes

also that it could be satisfactory to account for goodwill

as other intangible assets with definite useful life are

accounted.

26