Press, Journal Article

3

3

PRICE POINT

3

A much more likely outcome is that we see

an “ever

-

greening” or a rolling over of bad

debt over the next few years, given China’s

unwillingness to let financial firms fail, its

emphasis on stability, and its huge current

account surpluses and foreign exchange

reserves.

There is the risk that avoiding the pain of

deleveraging swiftly and kicking the can

down the road will exact a heavy toll on the

economy longer term.

That is one reason why we expect growth to

continue to slow unless China enacts more

transformational reforms that will improve

efficiency and productivity in the economy.

THE STOCK MARKET AND CHINA

LEADERSHIP

Despite a decline of 45% in China’s

Shanghai Composite Index last summer,

China was one of the better-performing

regional stock markets last year, with a gain of 9.4% in U.S. dollars, based on FactSet data. However, the steep

decline at the start of this year reflected renewed fears about China’s economy, currency, and management.

So far this year, the government has had to reverse policy and suspend newly installed circuit breakers that shut

down the market twice in one week. There is no doubt that Chinese policymakers are struggling to balance state

control with more market-driven pricing mechanisms.

It is important to remember that China alone is not to blame for the turmoil in global equity markets early this year.

Investors are also concerned about U.S. and global growth, the declining oil price, the outlook for corporate

earnings, and the Federal Reserve’s move to finally begin

raising interest rates.

OPPORTUNITY AND OUTLOOK

Despite the turmoil in China’s stock market, we continue to find attractive companies where the long

-term benefits

should outweigh the near-term risks. One key area of focus is disruptive technology. In

vesting in some of China’s

high-growth Internet stocks has been very profitable.

We also find opportunity in the consumer and service sectors, with Chinese consumers moving up the value-

added curve, buying more expensive, higher-quality items. In the services area, health care and logistics offer

promising opportunities. We also see potential in reform beneficiaries

—

state-owned enterprises that should

benefit from change in government policy over the next few years.

Recent events do not change our longer-term view on China or the rest of Asia. We expect the China market to

offer attractive growth opportunities for many years to come. Also, the structural growth story in Asia remains

robust. Economies are growing at healthy levels in a global context, supported by large, often young populations

that are moving up the income curve.

As we get more clarity on China’s currency framework, we expect volatility to subside, allowing investors to focus

on the more positive features of the China and Asia story once again.

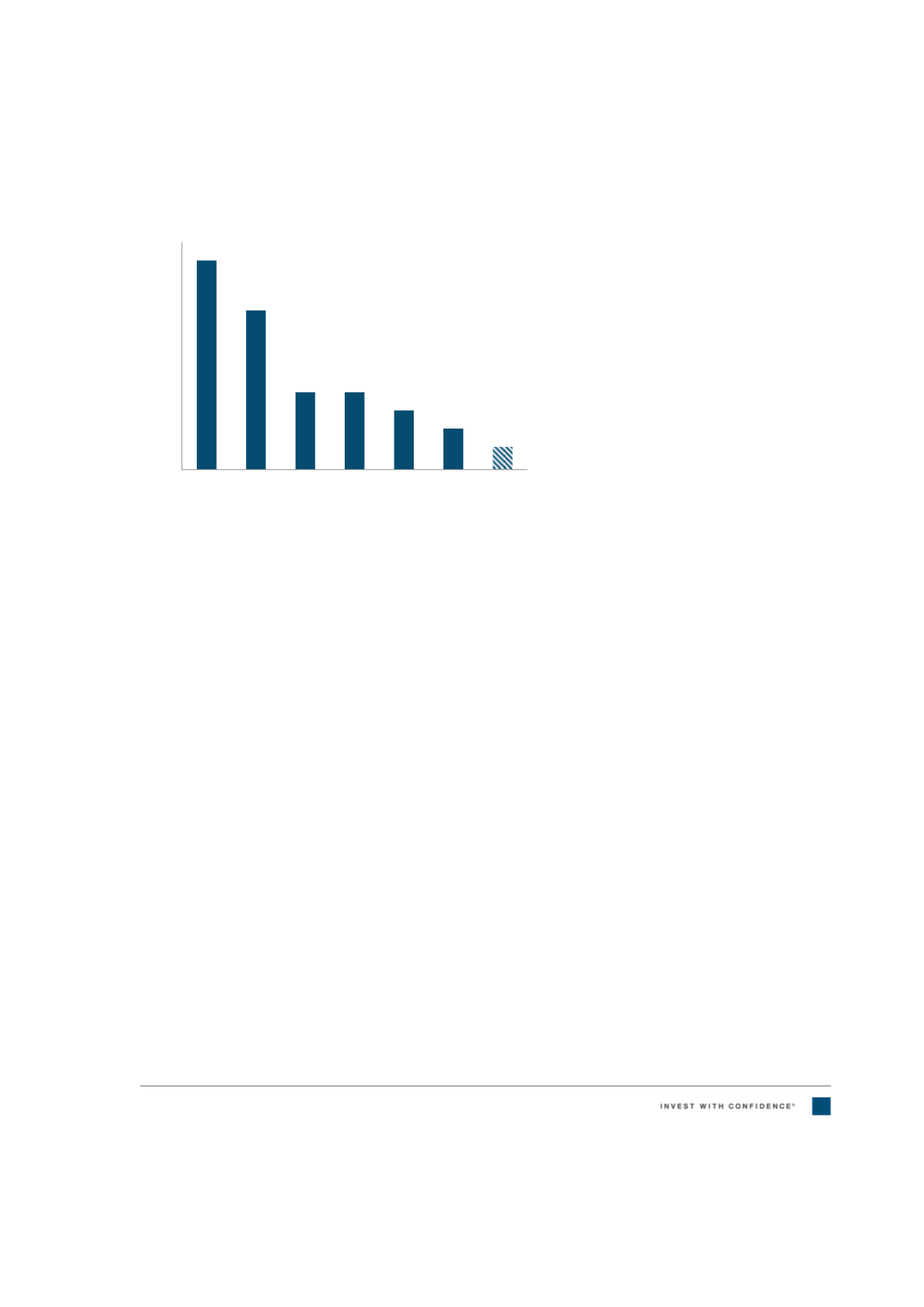

Figure 2:

China Real GDP Y/Y%

A Sharp Slowing in Economic Growth

Sources: Bloomberg and China National Bureau of Statistics. As of January 2016

6.0

6.5

7.0

7.5

8.0

8.5

9.0

9.5

10.0

10.5

11.0

2010 2011 2012 2013 2014 2015 2016

latility

E

31