Press, Journal Article

2

Imagine the following situation: you overdraft your checking account

and the bank calls asking for more funds (and charges you a hefty

fee). Instead of running the overdraft, you call someone else who also

banks at your bank and ask them to lend you money to cover your

overdraft. If they agree, then the bank simply debits their account and

credits your account. No more overdraft.

The “phone a friend” equivalent in banking is an unsecured overnight

market where banks borrow and loan reserves. The rate of interest

banks charge each other is the famous “federal funds rate.” Before

2007, this “phone a friend” market was a small, yet important mar-

ket. Total reserve balances averaged just $11 billion (mostly to meet

reserve requirements, no excess savings). Excess reserves, those bal-

ance held above and beyond the call of regulations, averaged just $1.5

billion!

2

Since the market was so small, the Fed could manipulate the

federal funds rate by either making reserves more scarce (for higher

rates) or more plentiful (lower rates) relative to market demand.

POST-2008: MORE MONEY, MORE PROBLEMS

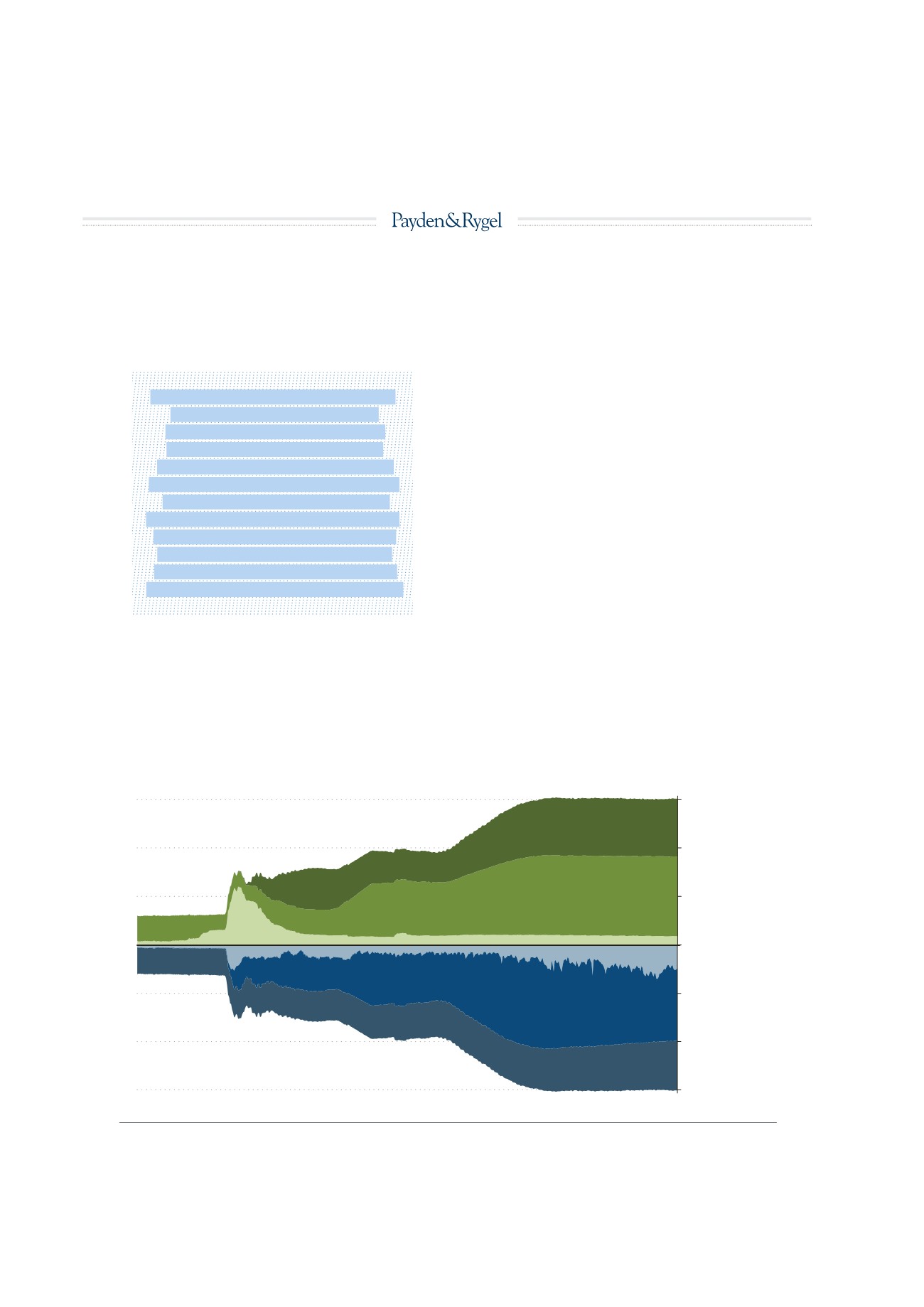

Under successive QE programs, the Fed increased the size of its bal-

ance sheet from $800 billion to more than $4.5 trillion (

see again Fig-

ure 2

). How did that happen? The Fed created $2.6 trillion in new

lia-

bilities

(reserves). Those reserves were exchanged with member banks

for great quantities of Treasury notes, Treasury bonds and agency-

backed MBS (the Fed’s assets).

As a result, today there is

anything

but a scarcity of reserves!

Of course, the surfeit of reserves created a new problem for the Fed:

how to control the “phone a friend” interest rate when so many re-

serves were available. Why “phone a friend” when your account is

flush with cash? Indeed, trading volumes are 75% lower in the“phone

a friend” market than pre-crisis daily volumes.

At first the central bank settled on a solution: pay banks interest on

excess reserves to, in the words of the New York Fed, “reduce the in-

centive for [banks] to lend at rates much below IOER (Interest on Ex-

cess Reserves) providing the Federal Reserve additional control” over

the fed funds rate. If banks receive 100 basis points (the IOER for

holding onto reserves), they will not likely lend them out to someone

else for any less, thereby enforcing the federal funds rate.

Source: Federal Reserve Board, WSJ

*Weekly End of Wednesday Levels

$0.0

$1.5

$3.0

$4.5

Agency/MBS

Treasuries

Other

USD Trillions

$1.5

$3.0

$4.5

'07

'08

'09

'10

'11

'12

'13

'14

'15

'16

'17

Currency in Circulation

Reserves

Other

ASSETS

LIABILITIES

THAT BIG FAT BALANCE SHEET

fig. 2

«BEFORE 2007, THIS “PHONE

A FRIEND” MARKET WAS

A SMALL, YET IMPORTANT

MARKET. TOTAL RESERVE

BALANCES AVERAGED JUST

$11 BILLION (MOSTLY TO MEET

RESERVE REQUIREMENTS,

NO EXCESS SAVINGS). EXCESS

RESERVES, THOSE BALANCE

HELD ABOVE AND BEYOND

THE CALL OF REGULATIONS,

AVERAGED JUST $1.5 BILLION!»

48