36% OF THE COMPANIES WISH TO REDUCE

THE BUDGET CYCLE TIME

This acceleration is achieved through reduced involvement of the operational staff: 25% of respondents do not involve

the operational staff in 2015 vs. 17% in 2014. This phenomenon is even more significant in the Anglosphere

companies (35% of respondents do not involve operations in 2015).

Regarding the use of rolling forecasts, 57% of respondents have implemented this process or plan to implement it,

which is very close to the answers of the previous year (60%). After several years of growth in the use of this process,

it appears that stability has been reached. In terms of the business markets, we observe that the companies in the

consumer goods and energy markets are the biggest users of this process, with a rate of implementation near 55% vs.

39% for the whole sample.

In contrast, there is more consistency in the use of rolling forecast in the different geographical areas: 38% of

European companies report having implemented this process vs. 36% of their counterparts in the North American

area. We found more variance between the two areas in 2014.

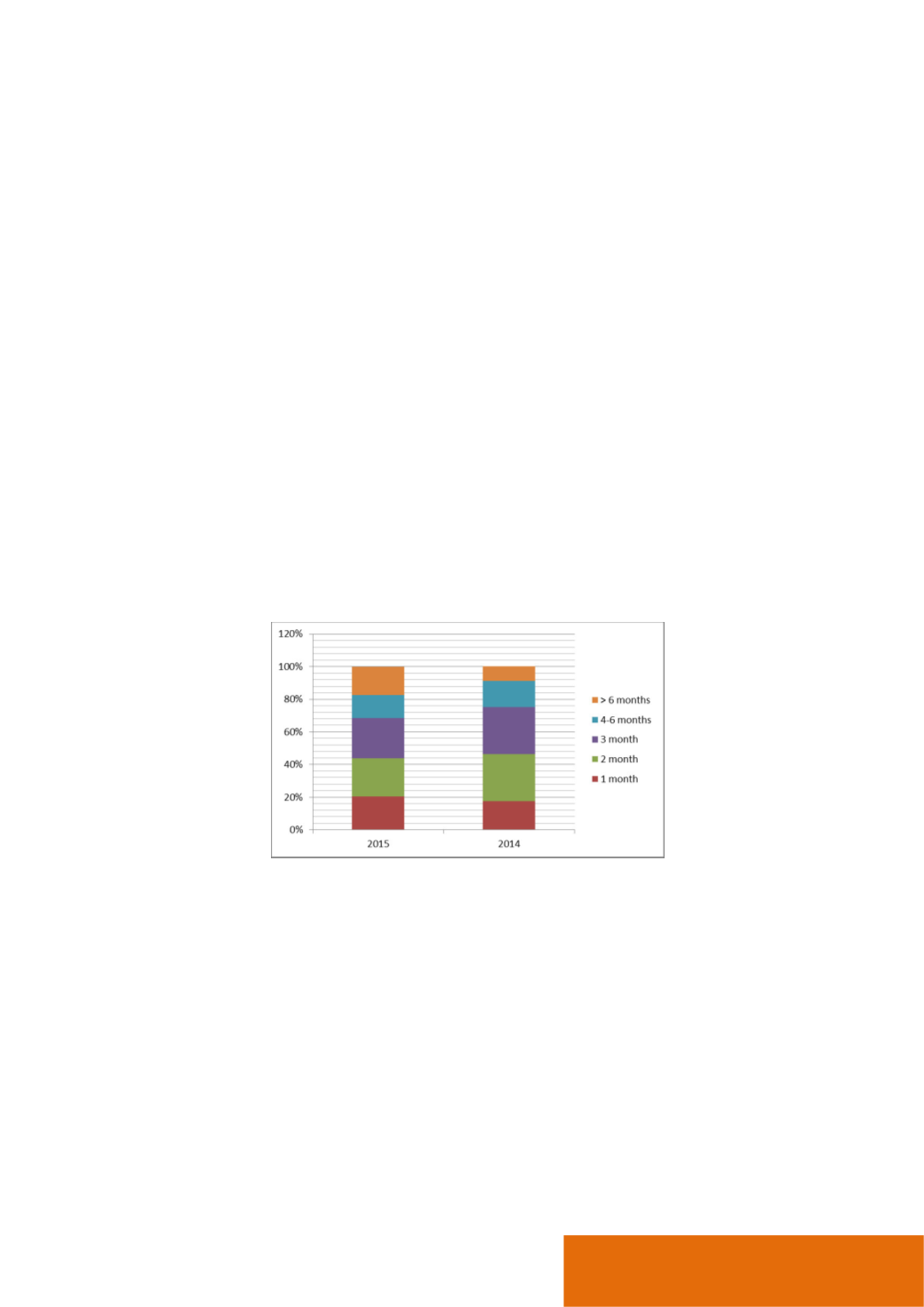

Desire to reduce the budget cycle time: is this wishful thinking?

Although the current reality tends to show an increase of the time spent on the budget process compared with the

previous year (see graph), 36% of companies plan to change their budget process, with the main objective of reducing

the budget cycle time while maintaining the same level of detail. The budget is still considered as a management tool

requiring a fairly detailed level.

Considering the 2015 results, the wish to reduce the duration of the budget cycle is not yet reflected in the current

practices; there is a slight reduction of the number of companies that produce their budget in less than 3 months

(69% in 2015 vs. 73% in 2014).

Fig. 15 Budget cycle time

There is a 10% decrease from 2013 to 2015 (see chart below) of the involvement of the operational staff in the budget

process. This trend may be linked to the desire of the finance teams to reduce the budget cycle time (reduction of

steps back and forth from finance to operational staff), even if it goes against a greater involvement of finance in the

operations (role of business partner). This development might also be linked to the development of a top-down

approach that reduces collaboration with operational staff when producing the budget.

This trend is stronger in the U.S. and U.K. with an average of 26% of companies that do not involve the operational

staff against an average of 13.6% of all respondents.

IAFEI Quarterly | Special Issue | 20