staff). The involvement of the finance-control function in mergers and acquisitions or in project management control

does not seem to be linked to the size of the companies, and neither does the frequency of reforecasting or the level

of transparency of the respondents regarding the planning, budgeting, and reforecasting of their peers. Finally, all the

companies, regardless of their size, declare their willingness to simplify and develop the budget process, and nearly

half of them, again regardless of their size, have not planned to modify their information system in the short term.

Key issues synthesis

:

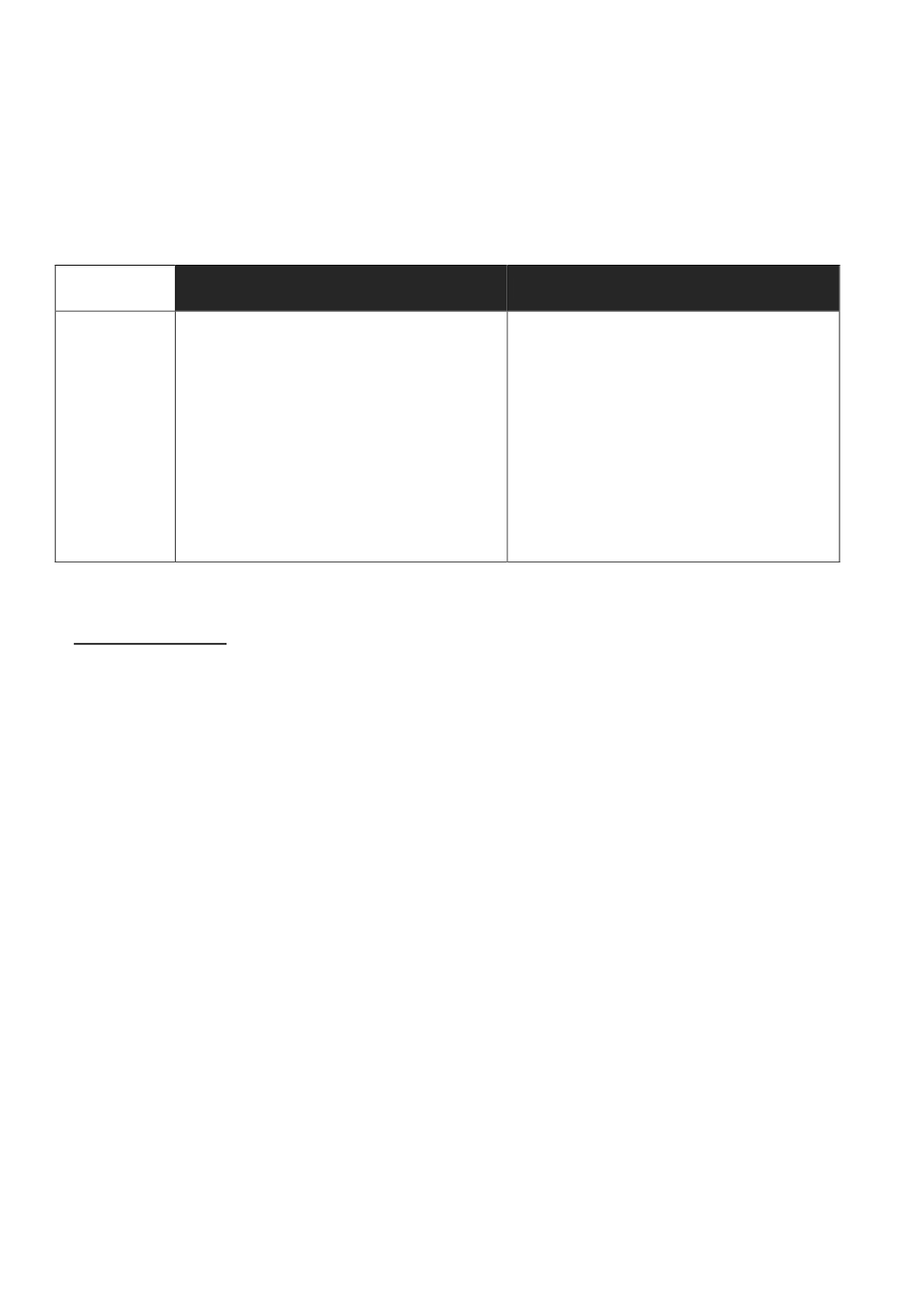

Variable

"Size"

Differences

Similarities

Small

companies

vs.

large

companies

- Time devoted to information systems

- Budget lead-time

- Importance given to reforecasting

- Involvement of operational staff in

processes

- Added value attached to reporting, planning

and budgeting

- Involvement of management controllers in

economic studies and corporate social

responsibility reporting

- Use of rolling forecast

- Evolution of the reporting system

- Added value attached to reforecasting,

business reviews and management of

operational staff

- Involvement of the finance-control function

in mergers and acquisitions or project

management control

- Visibility of peers' activities

- Willingness to improve budgeting process

- Desire to modify or redesign information

systems

Sector-based analysis

The industry sector stands out clearly from the others.

It is in the industry sector that the finance-control function is

more involved in economic studies (82% vs. 59% in services), in cash forecasting (72 % vs. 60 %), or in project

management control (84% vs. 60%-70% in services and others). It is still in the manufacturing companies that the

management controllers are the most involved in mergers and acquisitions (54 % for industry vs. 47% in services and

39% in others). The reporting lead-time - even though it has improved overall - is longer in the industry sector (40%

within 5 days vs. 49% in services). Industry makes greater use of reforecasting (frequency and time devoted) - 30%

each month vs. 17% for the other sectors - mainly as a tool for monitoring corrective action plans. It is also by far the

largest user of rolling forecasts (46% vs. 30% on average for the other sectors). It is also in manufacturing that the

weight of headquarters in the choice of IT systems is most dominant (62% vs. 52% in services). Expectations regarding

the role of IT are also more homogeneous and focused upon automated reports, search functions, and the integration

of tools. Industry tends to justify the absence of information systems redesign through the lack of resources, but this

sector insists less than the others sectors on the lack of methods or stability in companies or on the inadequacy of the

tools available. This could be explained by the fact that industrial companies are historically more structured than

others because of the complexity of their activity.

Companies in the three sectors we identified also share numerous similarities

. Regardless of the environment, the

controllers interact with the other support functions, thus confirming the essentially cross-functional aspect of their

function. The involvement of the finance-control function in the reporting devoted to sustainable development/CSR is

also similar in the various sectors. As for tools, spreadsheets remain the most used tool, regardless of the business

sector. In all areas, though Big Data is clearly identified as a key topic, it not yet part of everyday life. Finally, a

distinction between the various sectors also seems irrelevant when considering the impact of the new technologies

upon

ouƌ ƌespoŶdeŶts’ pƌofessioŶ

.

Key issues synthesis

:

IAFEI Quarterly | Special Issue | 36