Dynamism-based analysis

Management controllers intervene even more markedly in cash forecasting in companies that have seen a certain

revenue reduction in 2015.

The most dynamic companies are highly visible

. It is in the most performing companies that the finance-control

function is most active in economic studies (83% vs. 63%), social responsibility or sustainable development reporting,

transfer prices, mergers and acquisitions, or management control of high technologies. It is also in those companies

that budgeting lead-time is short and that operational staff are the most involved in reforecasting. It is worth noting

that the growing companies are also more inclined to add controlling indicators (42% vs. 23% for the less dynamic

companies). Finally, they are less likely to underestimate the significance of Big Data (48% vs. 62% in declining

businesses).

Conversely, it is in the companies in difficulty that our respondents attach the strongest added value to reporting,

planning, and budgeting. In this category, management controllers are even more involved in cash forecasting and the

proportion of companies able to publish reporting within two days is the highest one (27%). Companies with declining

revenue are characterized by a less systematic appeal to strategic, financial, or operational indicators (except for HR

indicators). Although spreadsheets remain a very used tool, 12% of growing companies have a budgetary tool against

25% of the decreasing businesses. Furthermore, 13% of the dynamic companies have a budget preparation tool

compared to 25% of those that are going through difficult times. Does this mean that management tools make

companies less flexible? Proportionally, those companies are more willing to plan a project of information systems

redesign, but they are also the ones using the lack of resources to justify the absence of redesign.

The more dynamic companies and those that are not share similarities in various aspects

. There is no obvious link

between the degree of dynamism of companies and the time spent by the finance-control function on its different

activities. All the companies interviewed share the desire to streamline the budget process (although those most

willing to streamline the process are also the most dynamic). The frequency of reforecasting and the view of what

added value forecasting brings do not correlate with the level of growth. The same can be said of the involvement

level of operational staff (in operational and strategic planning or in budgeting), the visibility that the respondents

have regarding the strategic planning of their peers, the level of decision regarding the choice of information systems

or the strong future involvement of the finance-control function in the Big Data projects (even though people working

in growing companies appear to be more aware of this aspect).

Key issues synthesis

:

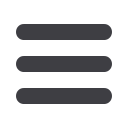

Variable

"Business sector"

Differences

Similarities

Industry

vs.

Services

- Main activities of management controllers

- Reporting lead-time

- Use of (re)forecasting and rolling forecasts

- Expectations in terms of information systems

- Decision level for selecting information systems

- Level of interactions between management control function

and other support services

- Involvement of the control function in sustainable

development and CSR reporting

- Use of spreadsheets

- Awareness of Big Data

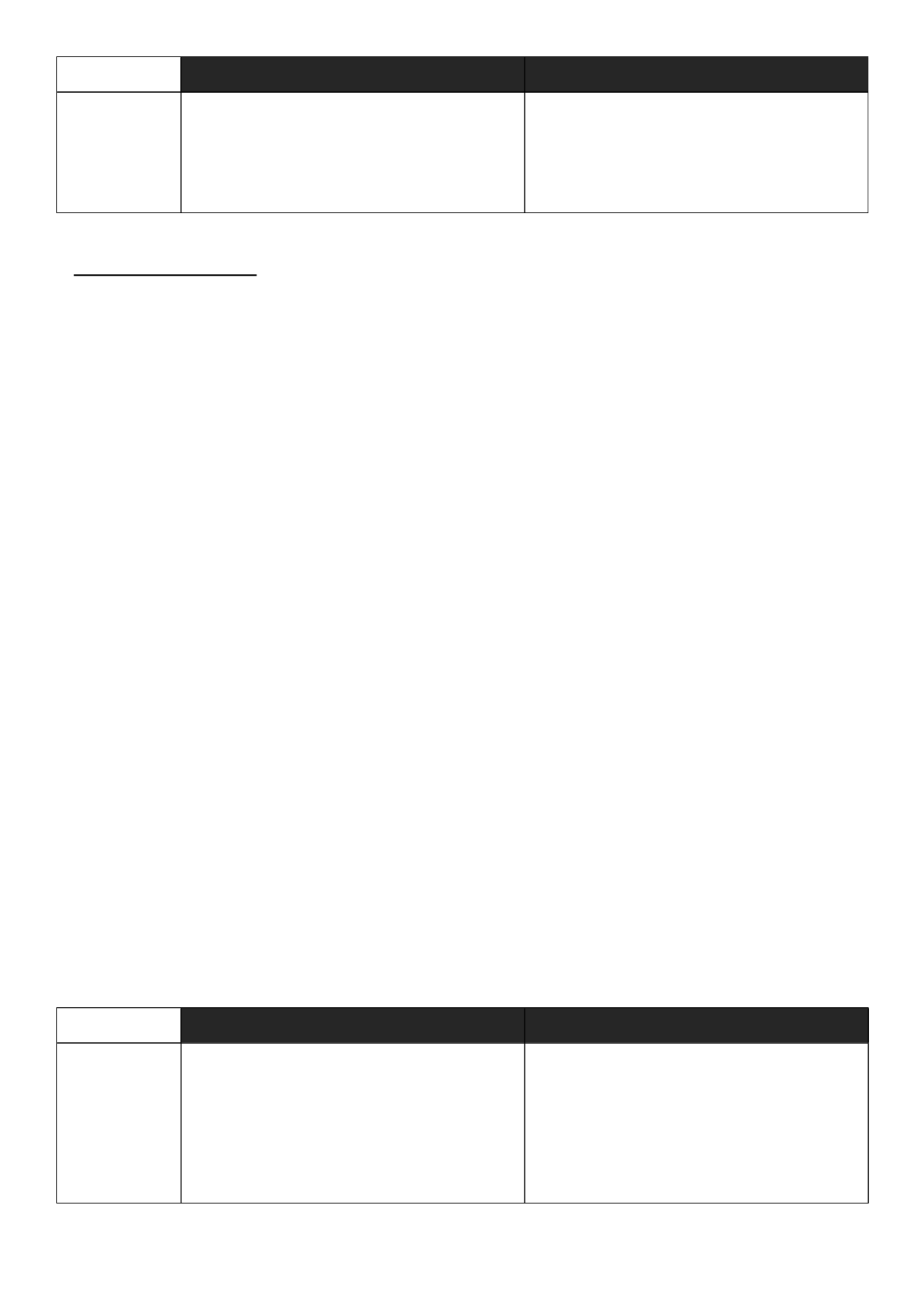

Variable

"Nationality"

Differences

Similarities

Western "culture"

vs.

Other "culture"

- Importance attached to project management control

- Main activities of the management control function

- Planning and budgeting lead-time

- Effective use of budgeting

- Frequency of reforecasting and time devoted to

reforecasting

- Main activities of the control function

- Degree and level of interactions between management

control function and other support services

- Willingness to improve processes

- Performance tools used

- Nature and frequency of publication of indicators

- Decision level for selecting information systems

- Reasons for postponement/absence of information systems

modifications or redesign

IAFEI Quarterly | Special Issue | 37