International Working Committees

WHICH ARE CFOS PERCEPTIONS ON

GOODWILL WRITE-OFF UNDER IFRS/US-GAAP?

By Marco Allegrini, Chairman IAFEI IFRS Committee

and Silvia Ferramosca, Phd in Business Economics, Post Doctoral Research Fellow, University of Pisa

Introduction

The present work is the result of a project started at the

University of Pisa in the Spring 2015 aimed at analysing

whether the CFOs or people working in similar positions

perceive that goodwill write-offs (GWO) may be used

discretionally. This research has been embraced by the

IAFEI IFRS Committee.

Indeed, both under IAS/IFRS and US GAAP managers

may exploit the flexibility of the accounting standards

because they have incentives to do so or, conversely,

because they signal to investors the company future

perspectives.

Research design and survey delivery

We designed the initial questionnaire grounding on

prior academic literature on goodwill write-offs and on a

recent questionnaire on the subsequent measurement

of goodwill available on the website of the European

Financial Reporting Advisory Group and of the OIC

(Organismo Italiano di Contabilità) (EFRAG and OIC,

2014). We then piloted five tests

1

asking feedbacks

on the following aspects: structure, length, wording,

possible omissions and/or undervalued properties. The

pilot tests to completely respond to the questionnaire

lasted between 4 to 18 minutes. After the tests we were

recommended to insert a question on the demographics

and few other minor revision to the wording and format.

We sent the survey link to the LinkedIn connections

of one of the group researcher with CFOs previously

added to the connection network. From mid July 2015

we began sending the survey to CFOs from all over the

world and by mid of March 2016 (eight months) we

totally surveyed 1,712 CFOs. By the end of March 2016 a

number of 461 CFOs responded to our survey invitation.

Considering the successful rate of responses (26.9%) we

did not proceed to send the invitation to require the

involvement of non-respondents.

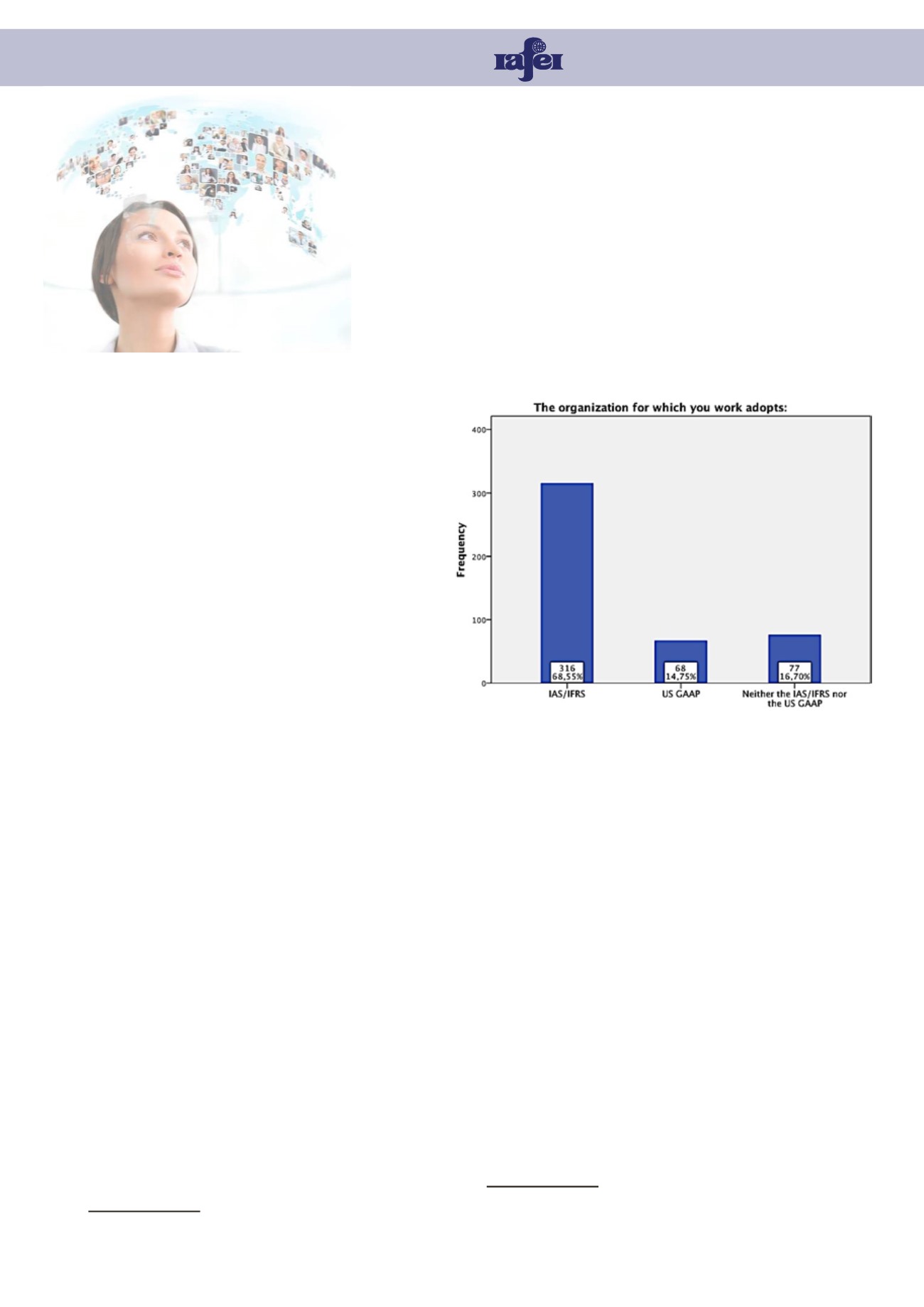

In the full sample of 461 participants, 316 work for an

organization adopting the IAS/IFRS, 68 the US-GAAP

and the remaining 77 in organizations adopting national

accounting standards (but not IAS/IFRS nor US-GAAP).

1

The pilot test were conducted on five persons: a Full Professor in Accounting, a Researcher

whose main interests are on Accounting and Corporate Governance, a Ph.D. Student in

Statistics, a Ph.D. Student in Accounting and Finance and a Chief Professional Accountant.

Survey respondents

The final sample of 384 participants includes mainly the

responses of CFOs (303, almost the 80% of the sample),

of Controller or Financial manager (29), Chief Audit

Executive or people working in top audit position (3)

and other comparable position (15)

2

, the remaining 34

answers are missing.

About the 52.9% work in a privately held (non-listed)

company, while the 44.6% in publicly-traded (listed)

companies, only 1.3% in public sector companies and

another 1.3% in other type of organizations.

In terms of total revenues, about the 51.9% of the

participants works in companies with revenues lower

than 500 million dollars, the 29.2% in companies with

revenues ranging between 501 million and 5 billion

dollars while the remaining 18.8% in companies with

total revenues higher 6 billion dollars.

2

Specifically, the 15 other position are: managing director, assistant CFO, CFO of a subsi-

diary, corporate finance, finance director, IFRS and ICF manager, administrative manager,

Vice-president corporate development, head of finance and accounting, head of repor-

ting department, Regional CFO, head of consolidation and controlling, divisional CFO,

head of economy and budgeting and independent board member/audit committee.

24